SPEND TIME ON YOUR BUSINESS.NOT SALES TAX.

Let TaxJar automate your sales tax calculations, reporting, and filings in minutes.

Easily connect to the places where you sell

- Merchants: Simple one-click connection to your marketplace or cart. Say goodbye to spreadsheets and messy CSVs.

- Developers: View our demo and get your API token instantly! Use our docs to send your first API call for your custom cart.

TaxJar instantly prepares your state return-ready reports

- Merchants: Use TaxJar Reports to finish your returns in minutes, or choose to automate your filing with AutoFile.

- Developers: Share TaxJar Reports with your clients to help them easily remit their sales tax payments to the state.

Enroll in AutoFile.You’re done!

- Merchants & Developers: Choose to automate your filings with AutoFile and let TaxJar handle filing.

- Never miss a due date again. On-time, every time.

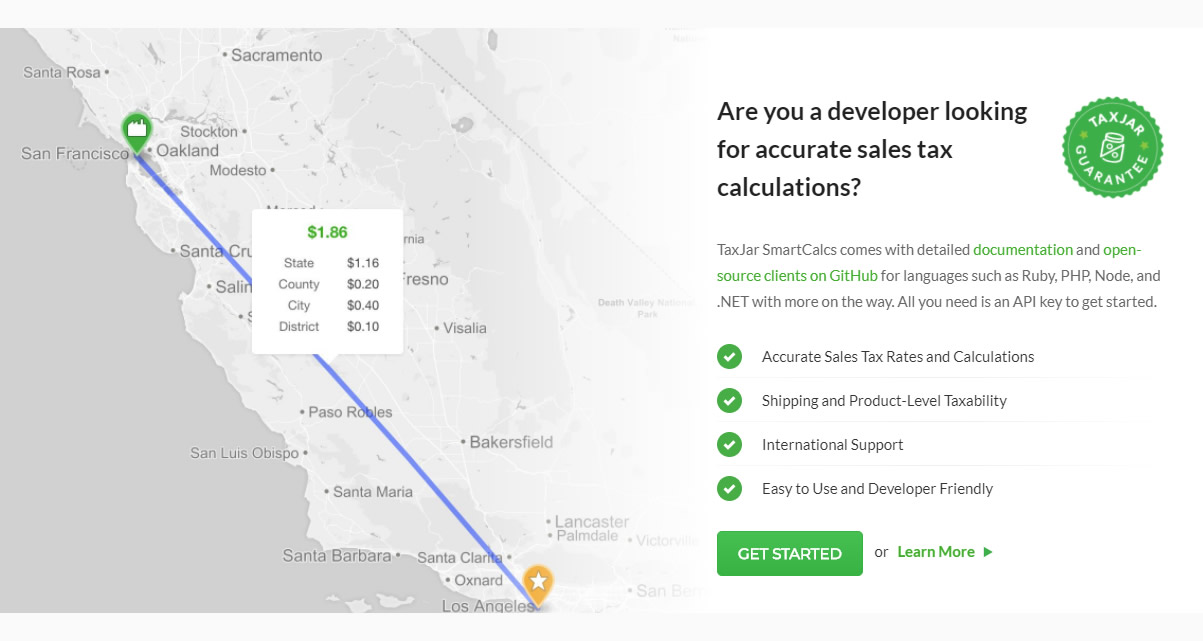

Are you a developer looking for accurate sales tax calculations?

TaxJar SmartCalcs comes with detailed documentation and open-source clients on GitHub for languages such as Ruby, PHP, Node, and .NET with more on the way. All you need is an API key to get started.

- Accurate Sales Tax Rates and Calculations

- Shipping and Product-Level Taxability

- International Support

- Easy to Use and Developer Friendly

Still Learning About Sales Tax?

We’ve got you covered.

Dig into more than 600+ relevant articles.

Learn what you need to know, subscribe and join the conversation.

Common Questions

Feel free to contact us if you can't find the answer to your question. We're happy to help you.

Why should I use TaxJar?

TaxJar offers automated sales tax reporting and filing for multi-channel online sellers. Connect the online shopping carts and/or marketplaces where you sell just one time and we’ll download the data and prepare it so you can easily file sales tax returns in the states you have nexus.

We also offer the AutoFile feature which automatically files your returns on your behalf.

Don't Amazon and other eCommerce platforms automatically collect sales tax and help me file?

Platforms like Amazon, eBay and Shopify help you collect sales tax, but that’s it. They don’t help you with reporting or filing. That’s where TaxJar will save you hours of effort each month, quarter or year depending on how often you are required to file.

What if I already have a CPA?

That’s okay. Lots of TaxJar customers have CPAs. In fact, their CPAs find TaxJar’s reporting to be super helpful and save a bunch of time when it’s time to file sales tax returns.

Do I have to sign a contract?

No way. No contracts. No setup fees. No cancellation fees.

What happens if I go over my plan’s transaction limit, such as during the holidays?

If you go over your transaction limit during a single month, we will charge you the difference between the TaxJar plan you’re on and the next highest plan. The next month you’ll start back on the original plan that you subscribed to, and the process will repeat itself again. This is all done automatically. Your plan will never be interrupted and you will not have to speak with a salesperson.

Is the per-state cost of AutoFile included in my monthly fee?

No. AutoFile is an additional fee and is charged any time we file a sales tax return for you.