Get bank beating rates on global money transfers

Save up to 75%* on the rates banks charge with OFX.

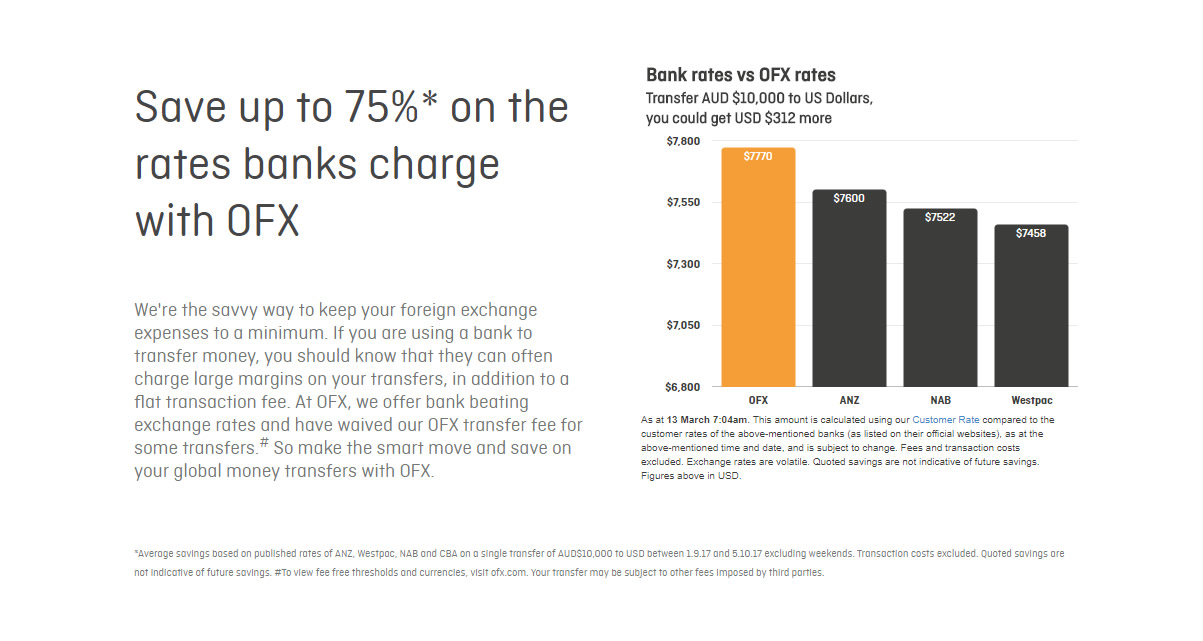

Save up to 75%* on the rates banks charge with OFX

We’re the savvy way to keep your foreign exchange expenses to a minimum. If you are using a bank to transfer money, you should know that they can often charge large margins on your transfers, in addition to a flat transaction fee. At OFX, we offer bank beating exchange rates and have waived our OFX transfer fee for some transfers.# So make the smart move and save on your global money transfers with OFX.

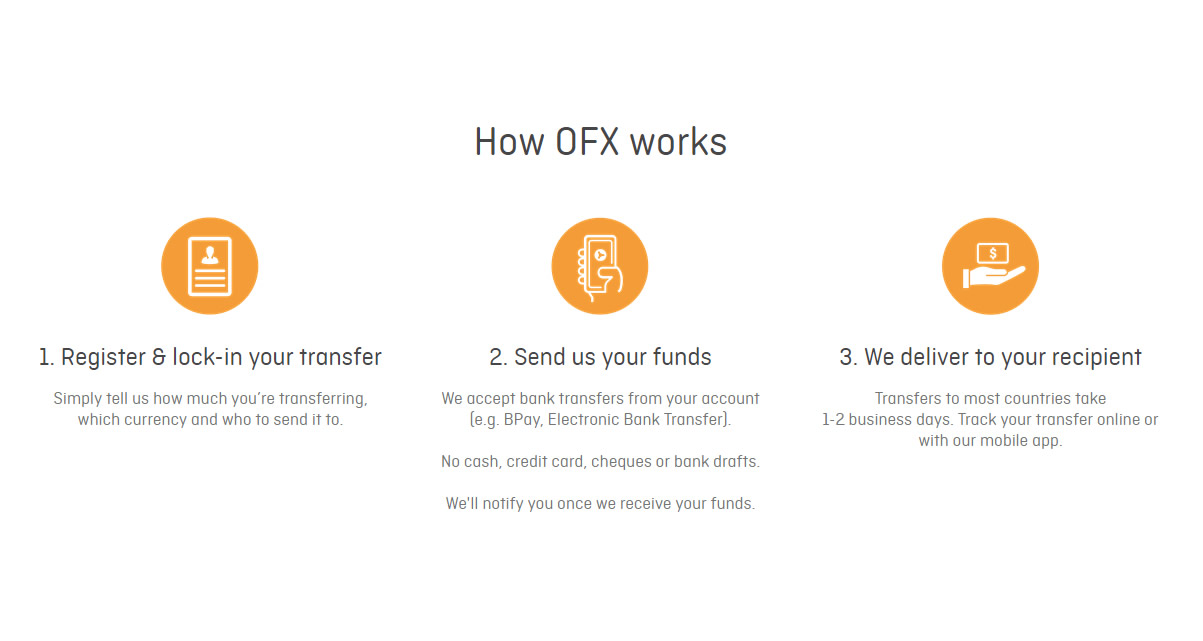

How OFX works

Register & lock-in your transfer

Simply tell us how much you’re transferring, which currency and who to send it to.

Send us your funds

- We accept bank transfers from your account (e.g. BPay, Electronic Bank Transfer).

- No cash, credit card, cheques or bank drafts.

- We'll notify you once we receive your funds.

We deliver to your recipient

Transfers to most countries take 1-2 business days. Track your transfer online or with our mobile app.

Why choose OFX?

Regulated

We're regulated by ASIC (Australian Securities and Investments Commission) and our parent company is listed on the Australian Securities Exchange (ASX).

Global support team

Our experienced support staff are in our global offices in Australia, USA, UK, Canada, New Zealand, Hong Kong and Singapore.

Great rates

We've got better rates and fees than the banks, and have securely transferred over $100 billion worldwide since 1998.

Frequently Asked Questions

- Can my driver’s licence be used as both photo identification and address?

- Do I need to register to make a transfer?

- How long does it take to verify my identity?

- I’ve registered – when can I make a transfer?

- Can I cancel my transfer?

- Can I get a currency exchange quote?

- Can I transfer money from another country to Australia with OFX?

- Do you have a minimum transfer amount?

- How do I make a transfer?

- How do I transfer my funds to OFX?

- How should I transfer USD to OFX from a US bank account?

- I forgot to add my Client Reference number to my bank transfer! What should I do?

- What is the maximum amount you can transfer?

- What is the minimum transfer amount?

- What Do I Need to Make an International Bank Transfer?

- What should I do after I’ve locked-in my transfer and sent my funds to OFX?

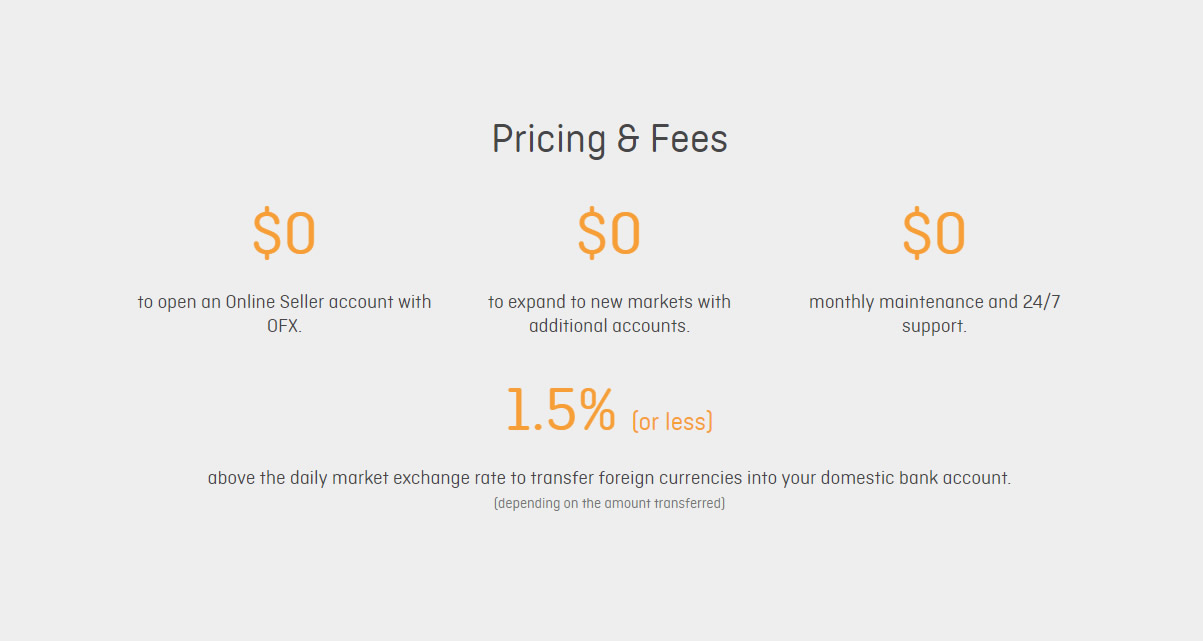

- Are there any transfer fees?

- How much does it cost to send money internationally?

- What currencies can I make a transfer with OFX?

- What's an international transaction fee?

- What's the cheapest way to send money?

- How can I track my transfer?

- How do I check my transfer history?

- How long does a bank to bank transfer take?

- How long does a bank to bank transfer take?

- How long will my transfer take?

- How Long Do Online Payments Take?

- What's a maturity date?

- What time of day are transfers usually completed?

- Which is the fastest way to transfer money to OFX?

- Can I bring forward or extend the maturity date of a Forward Exchange Contract?

- Can I cancel a recurring transfer plan anytime? Are there any conditions?

- Can I extend the maturity date of my transfer?

- Can I lock-in a rate before I send you my funds?

- Do I need to pay a deposit for a recurring transfer?

- How much does it cost to set up a recurring transfer?

- How to Transfer Money from One Bank Account to Another

- What is a single transfer?

- What’s the best way to send money online?

- What is a wire transfer?

- How do I add a recipient or edit their details?

- Why can’t I see the recipient I just added online to make a transfer to?

- What should I do if I didn’t add my recipient’s reference to my transfer?

- Is it safe to wire money?

- What are the warning signs of wire transfer fraud?

- Why should I choose OFX to transfer money?

- What can I do with the OFX app?

- What should I do if I have problems installing or using the app?

- Which platforms support the OFX mobile app?

- Do you accept part payments?

- How do I add a new currency to my profile?

- How do I update my personal details?

- How long is a live exchange rate valid for?

- How Do I Find My ACH Routing Number?

- I had funds on my OzForex Travel Card, what happens to them now that it's closed?

- I have an OzForex Travel Card, what do I do now that it is closed?

- I’ve forgotten my username or password – what should I do?

- What is a forward contract?

- What is a routing number?

- What are SEPA Transfers?

- What are Spot Rates?

- What is an IBAN?

- What Is NEFT?

- What is BSC?

- What is CHIPS?

- What is IFSC?

- What is NCC?

- What’s my Client Reference number for?

- What should I do if my debit card payment results in an unknown error?

- What is the OFX Customer Rate?

- What is the market rate or interbank rate?

- Are my funds secure?

- Are there any account or transfer fees?

- Can I make payments out of my receiving account directly to my suppliers?

- Can I obtain a certificate to verify my receiving account details?

- Can I use my receiving account details with more than one marketplace?

- Can I view a history of my transfers?

- Do I need to provide documents when I register?

- Do the documents need to be notarised or certified?

- How do I enter the bank details for my home account on the OFX website?

- How do I setup an online seller account with OFX?

- How do I upload my receiving account details to my online marketplaces?

- How long does it take to open an account with OFX and receive my receiving account details?

- Is there a minimum amount of time I must have an OFX account for?

- What is the transfer process and how long will it take?

- Which currencies can the receiving accounts receive?

- Which online marketplaces are compatible with the receiving accounts?

- Will I be notified when my receiving account receives funds?

- Who else can send money to my receiving account?