U.S. Legal Help for Businesses and Families in Indonesia

We’ve helped over 2 million people get the help they need

LLC? C Corp.? S Corp.?

Confused about your options? Answer a few simple questions and find out which one may be right for you.

Quality You Can Trust

Over the past 12 years, over 2 million businesses and families have used LegalZoom for their Wills,Trademarks, LLCs and more.

Have Legal Questions?

Get help from a legal plan attorney when you need it. No expensive hourly fees. No surprise pricing.

Have Legal Questions?

Get help from an experienced attorney. Schedule your consultation at a time that works for you.

LegalZoom provides the legal solutions you need to start a business, run a business, file a trademark application, make a will, create a living trust, file bankruptcy,change your name, and handle a variety of other common legal matters for small businesses and families. Since the process involved in starting a business can be complicated, we provide services to help start an LLC, form a corporation, file a DBA, and take care of many of the legal requirements related to starting and running a business. If you are interested in protecting your intellectual property, LegalZoom offers trademark and copyright registration services, as well as patent application assistance. It’s essential for everyone to have a last will and testament and a living will, and you can get yours done efficiently and affordably through LegalZoom. For those who have more advanced planning needs, our living trust service is available. With all our services, you have the option to speak to a lawyer and tax professional. Let LegalZoom take care of the details so you can focus on what matters most – your business and family.

LLC (Limited Liability Company)

- Shield your personal assets from business liabilities.

- The flexibility to run your business as you wish.

Over 1 million businesses have trusted us to get started

Over the past 12 years, we’ve gotten pretty good at helping people launch their businesses. In fact, we’ve helped over 1 million of them.

Our customer care representatives in the United States will be there to support you throughout the lifetime of your business.

Our attorneys continually maintain our documents to be up-to-date with the latest legal requirements in each state.

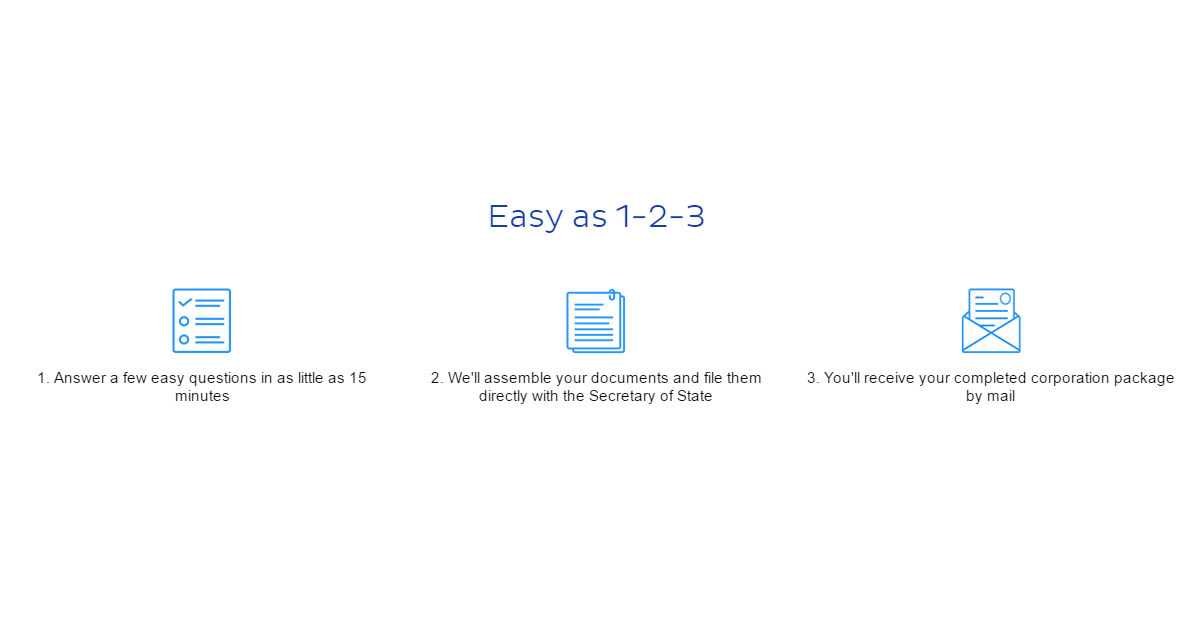

Easy as 1-2-3

1. Answer a few easy questions in as little as 15 minutes

2. We’ll assemble your documents and file them directly with the Secretary of State

3. You’ll receive your completed Limited Liability Company package by mail

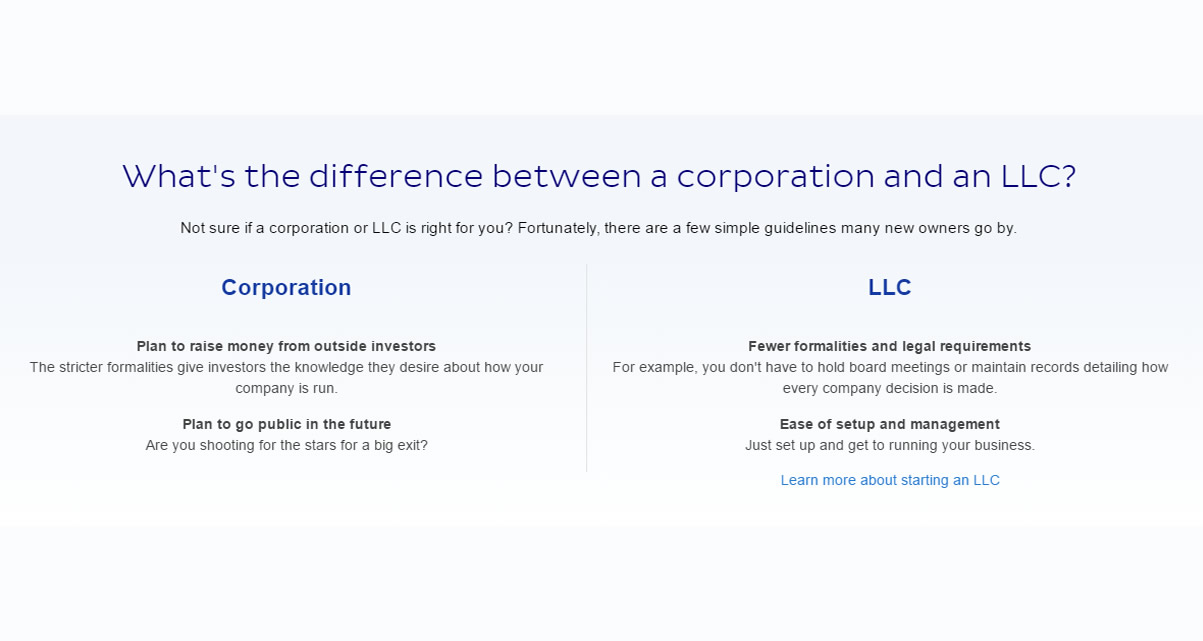

What’s the difference between an LLC and a corporation?

Not sure if an LLC or a corporation is right for you? Fortunately, there are a few simple guidelines many new owners go by.

For example, you don’t have to hold board meetings or maintain records detailing how every company decision is made.

Ease of setup and management

Just set up and get to running your business.

The stricter formalities give investors the knowledge they desire about how your company is run.

Plan to go public in the future

Are you shooting for the stars for a big exit?

Incorporation (S-Corp, C-Corp)

Form a corporation with speed, value and ease

- Documents filed with the state forming your corporation.

- Personalized bylaws and resolutions defining who owns and manages the company.

Over 1 million businesses have trusted us to get started

Over the past 12 years, we’ve gotten pretty good at helping people launch their businesses. In fact, we’ve helped over 1 million of them.

Our customer care representatives in the United States will be there to support you throughout the lifetime of your business.

Our attorneys continually maintain our documents to be up to date with the latest legal requirements in each state.

Nonprofit

Starting off right is the first step in getting donor support.

Reasons to incorporate as a nonprofit

You're eligible for state, federal and certain other income tax exemptions.

Contributions to certain types of nonprofits are tax deductible.

Members and directors are shielded from personal liability for the nonprofit’s actions.

The term 501(c)(3) refers to a specific IRS tax code. To qualify, the nonprofit must meet IRS requirements. If your organization qualifies, we’ll help complete and file your application.

Only qualified nonprofits can receive grants from other nonprofits and government agencies. Also, contributions to qualified nonprofits are deductible on the donor’s income tax returns.

Sole Proprietorship

You don't need to file paperwork to start a sole proprietorship. But there are some things you may want to consider to get the most out of your business.

Is a sole proprietorship right for you?

If you're in business for yourself and you haven't created a formal business structure, then chances are,

you're already a sole proprietor–so make sure you understand the implications.

Sole proprietors are personally liable for the debts of their business. If the business is sued, your house, savings, and other personal assets are at risk.

A sole proprietor is responsible to report all business profits as personal income, and pay self-employment tax on those profits, to cover Social Security and Medicare.

There are no partners, shares, or membership interests in a sole proprietorship so it's generally difficult to attract investors without changing your business structure.

So you're open for business. What next?

A sole proprietorship is simple to start, but that doesn't mean you should let your guard down.

A little preparation goes a long way.

If you're a sole proprietor, the legal name of your business is your own name. In most states, if you want to operate the business under a different name, you'll need to file for a DBA, "doing business as."

Limit your liability

As a sole proprietor, you'll be personally liable for your business's debts and other liabilities. You may want to consider operating as a limited liability company (LLC) instead, so you're better protected.

You may need state or local permits and/or licenses to legally operate your business. We can help you figure out the business licenses you need.

Tax Advice

Business taxes can be complicated. Once you join our Business Advantage Pro legal plan, our partners at 1-800-Accountants can help you prepare and file your tax forms correctly and on time.

DBA (Doing Business As)

Make a first and lasting impression with your "doing business as" name.

Reasons to incorporate as a nonprofit

Use a different business name than your entity's official name or your personal name.

For sole proprietorships and general partnerships, many banks require a DBA.

Name new business lines and keep them separate to cut down on paperwork and expenses.

Your business name is how customers find and recognize you, so a unique DBA can have a positive impact. The registration process can also help you avoid legal problems by making sure you don't choose a name that's confusingly similar to another business in your area.

Every state and county has different regulations about DBAs. We don't just send you a blank form. We'll do a preliminary name search (where required) and file your DBA statement with the appropriate office. If proof of publication is required, we'll publish your DBA at no extra cost.

Dissolutions

If you ever decide it's time to dissolve your Corporation or LLC, you'll have to file what's known as "Articles of Dissolution." LegalZoom will not only create the necessary paperwork, but we'll also file it with the appropriate state agency.

Here's how it works

online questionnaire

Dissolution paperwork

the state and send you the paperwork

Corporate Dissolutions

If you ever decide it's time to dissolve your Corporation or LLC, you'll have to file what's known as "Articles of Dissolution." LegalZoom will not only create the necessary paperwork, but we'll also file it with the appropriate state agency.

Here's how it works

online questionnaire

Dissolution paperwork

the state and send you the paperwork

Annual Reports

After you form your company, it's important to protect its good standing by filing any mandatory reports with the state. Not all states require a report when you first set up your company, but most require that your company file either an annual or biennial report for as long as your company exists. Creating and filing your annual reports is fast and easy. Simply answer a few questions and we will complete your report and file it with the applicable state agency.

It's so easy

Frequently Asked Questions

There are many scenarios that could potentially impact the order delivery date, and occur on a case by case basis. There can be delays at the Secretary of State’s office in many states that could affect the delivery date. There could also be missing information that we may need from you that could delay Legalzoom from processing your order.

How do I set/up change my security question?

You may do so by logging into you LegalZoom account, and selecting the “Account” tab. Once this tab has been selected, you will be directed to your Personal Information form. This form allows you to edit your Personal Information, as well as add a security question which is able to be used for verification.

How many users can have access/login to my LZ online account?

You may allow as many users as you wish to access your online LegalZoom account. However, please keep in mind, in order for additional users to gain access to your online LegalZoom account, they must be able to successfully authenticate your username & password.

Can I change my Login Email?

Your Login email address is able to be updated by simply contacting LegalZoom Customer Care, and supplying your new login email address. It’s as easy as that!

I was charged $159 and I don’t know why?

You are able to view all transactions with LegalZoom by accessing your account online. When you are logged into your LegalZoom account, select the “Account” tab. Next, select the “Payment History” tab, and you will be able to view all transactions that have occurred on your LegalZoom account, as well as print transaction invoices! Of course, if there are any additional questions regarding the listed transactions you can contact Customer care to inquire further.

Can I view/download my documents from LZ website?

LegalZoom documents are prepared by our Document Specialists, and not computer automated. This allows us to perform our Peace of Mind Review™ to ensure your documents meet your state’s specific requirements, as well as reviewed for continuity and grammatical correctness. For these reasons, your documents are not available for online viewing/downloading.

Where do I find my documents that LegalZoom filed with the state?

LegalZoom customers are sent copies of all documents that we file with State & Federal government agencies. If additonal copies of these documents are needed, please contact Customer Care to request them, and we will happily send them to you.

How do I know if my biz name is approved? What is the process?

You are always able to monitor the progress of your order by logging into your online LegalZoom account. Your selected entity name will be submitted along with any additional required information for your business to be filed. Once your online account status has reached “Peace of Mind Review”, Your business has been successfully filed, and you busniness name has been approved.

How long can LegalZoom hold an order for me?

LegalZoom is able to place your order on hold for up to 1 year. Simply contact Customer Care via telephone to request your order to be placed on hold, and when you are ready to resume, Let us know and we will proceed!