Small Business Funding for the Real World

Get quick access to working capital with a Kabbage line of credit.

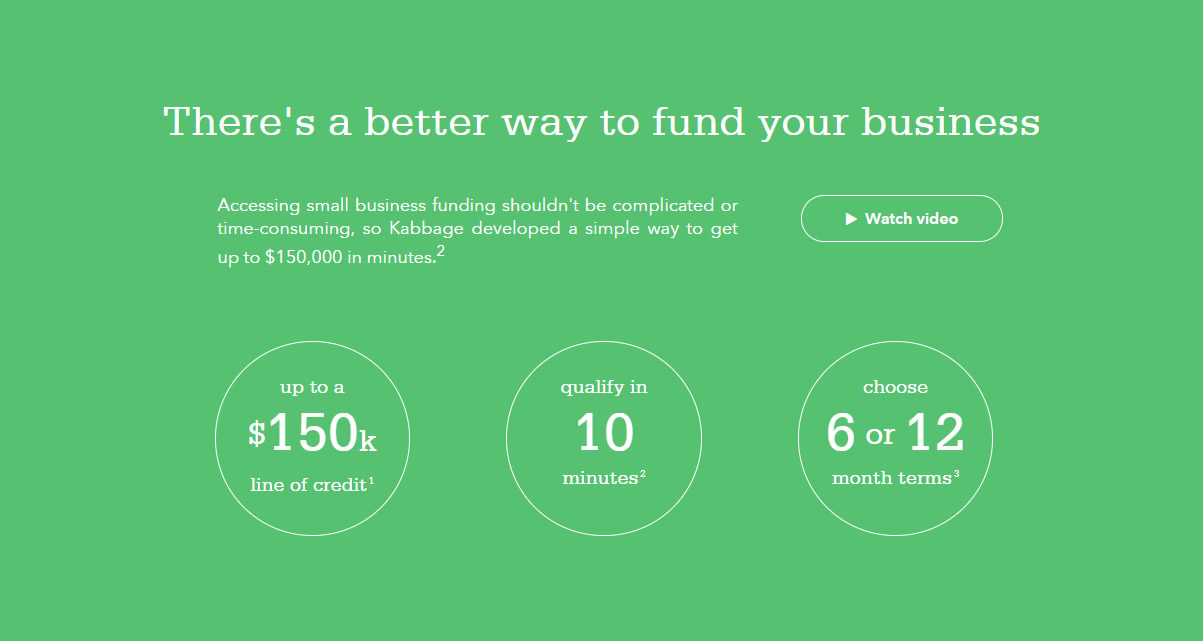

There’s a better way to fund your business

Accessing small business funding shouldn’t be complicated or time-consuming, so Kabbage developed a simple way to get up to $150,000 in minutes.

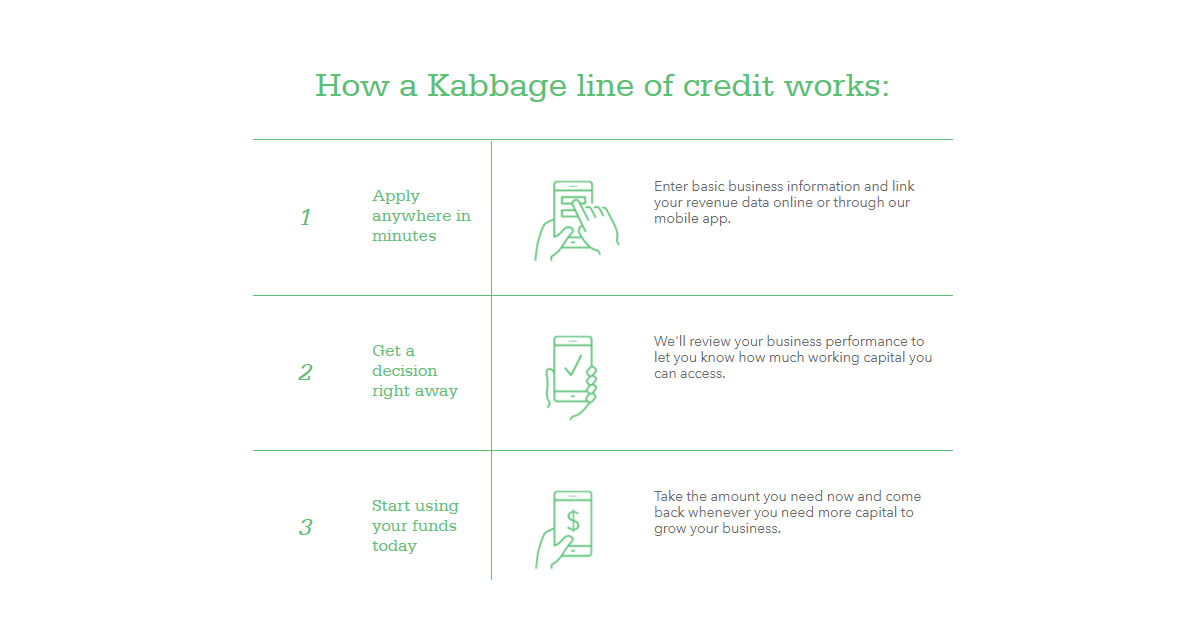

How a Kabbage line of credit works:

Apply anywhere in minutes

Enter basic business information and link your revenue data online or through our mobile app.

Get a decision right away

We'll review your business performance to let you know how much working capital you can access.

Start using your funds today

Take the amount you need now and come back whenever you need more capital to grow your business.

Small business funding options that fit your business

Flexible Funds

You decide when to use your funds and how much to take. As long as you have available funds, you can withdraw every time you need capital, up to once per day.

Transparent Terms

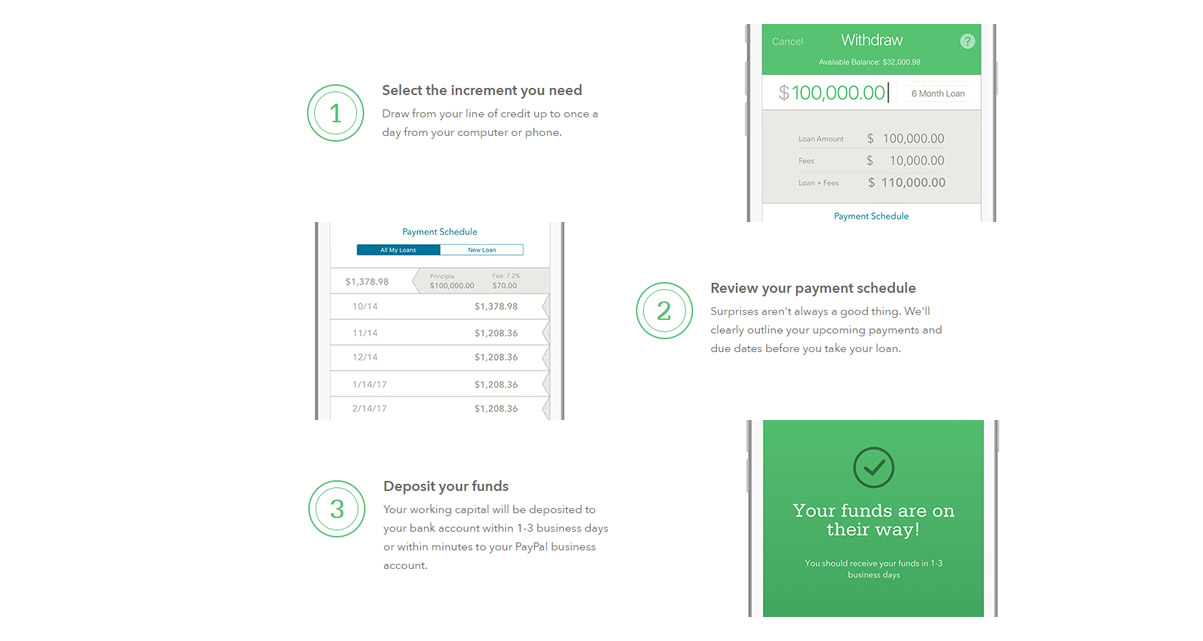

Kabbage small business loans have simple, monthly payments with no origination fees or prepayment penalties. You can review your payment schedule before taking a loan so there won't be any surprises.

Simple Process

Securely link your business information online to get an automatic financial review. This lets us evaluate your business right away without requiring you to track down financial statements.

Convenient Access

Withdraw from your line by logging into your computer, using our mobile app or swiping your Kabbage Card. You'll have the security of a line of credit you can use whenever you need it, wherever you are.

Trusted by Thousands

Kabbage customers have securely connected more than 1 million data sources. We’re A+ rated by the Better Business Bureau and are TRUSTe certified for our commitment to customer privacy.

Personal Service

From applying to managing your account and making the most of your capital, our in-house team of experts is here to help when you need it.

Get started now.Have working capital today.

Minimum requirements

To qualify for a small business loan, your business needs to be at least a year old. You should have revenues of $50,000 annually or $4,200 per month over the last three months. 4

Get the Kabbage app

Apply, use your funds and manage your account right from your phone with the Kabbage app. It's the best funding you can get with two thumbs.

HOW IT WORKS

Qualifying

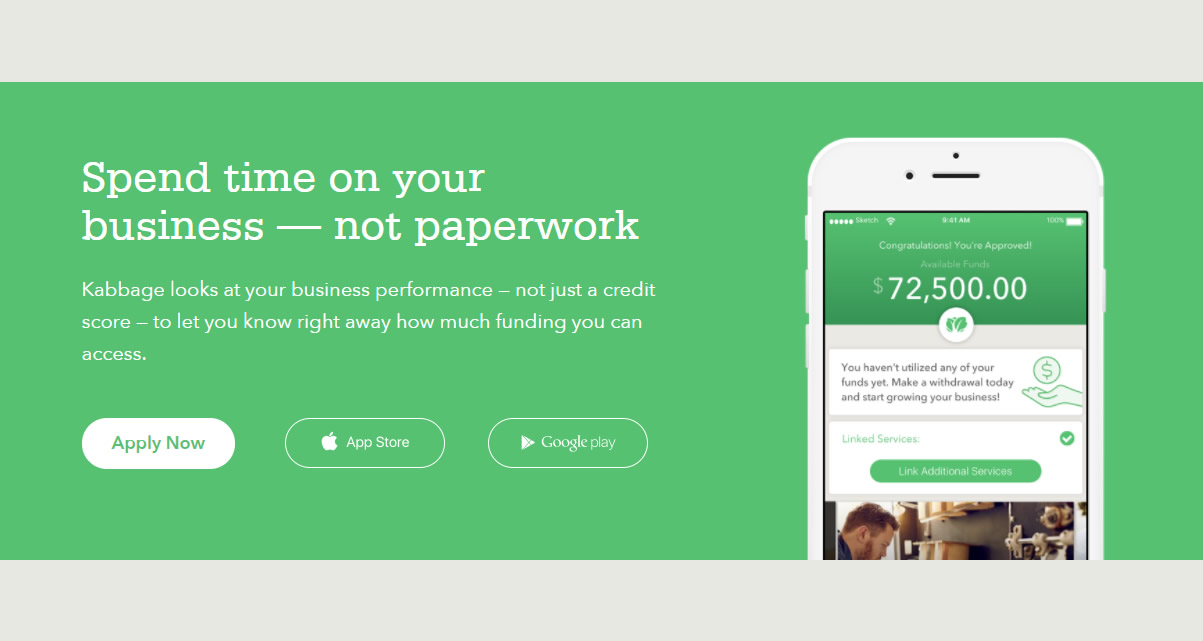

Spend time on your business — not paperwork

Kabbage looks at your business performance — not just a credit score — to let you know right away how much funding you can access.

Minimum qualification requirements

To qualify with Kabbage, you should be in business for at least one year and have a minimum of $50,000 in annual revenue or $4,200 per month over the last three months.1

- Applying is Free

- No Obligation to Take Funds

Taking Funds

Kabbage Card

Grow your business as fast as you can swipe. The Kabbage Card gives you access to your line of credit to buy inventory, order supplies, jump on timely business opportunities or cover unexpected expenses.

Dashboard

Withdraw the increment you need and have funds deposited directly into your account. Take funds as often as every 24 hours. You are only charged for the funds you take.

Kabbage App

With Kabbage's mobile app for iOS and Android, you can get a small business loan between status updates. Download the app to get approved, withdraw funds and manage your account no matter where you are.

Making Payments

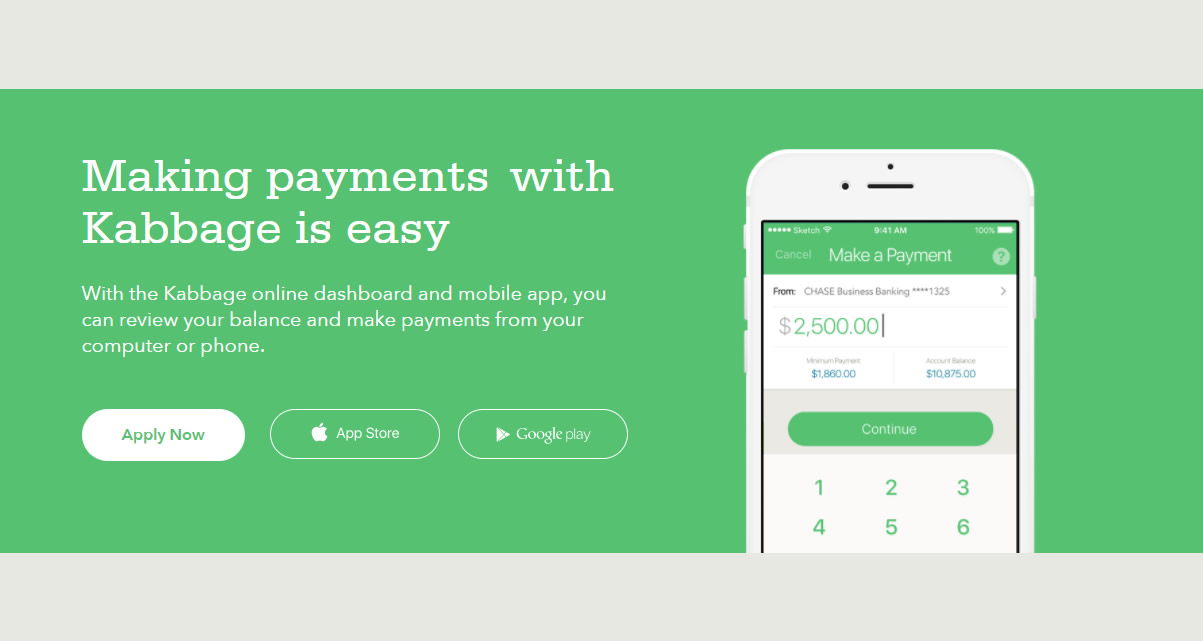

Making paymentswith Kabbage is easy

With the Kabbage online dashboard and mobile app, you can review your balance and make payments from your computer or phone.

More convenient than you imagined

- Monthly billing cycle

Each month, you’ll pay back an equal portion of your loan principal plus a monthly fee. You only pay the fee when you have an outstanding loan balance. - Autopay

Kabbage simplifies billing by automatically withdrawing your minimum payment from your primary account each month. You also can make manual payments at any time. - Consolidated payments

We’ll bundle all of your outstanding loans into one monthly payment so you don’t have to keep track of multiple repayment schedules.

Frequently Asked Questions

-

Kabbage is a technology company that quickly connects small businesses with capital. Our technology platform reviews data generated by dozens of business operations to automatically understand business performance and deliver fast, flexible funding entirely online.

-

Why do small businesses use Kabbage?

When polled, most business owners shared that access to capital is the single biggest roadblock to growing their businesses. With more cash flow, these businesses can hire new employees, purchase more inventory, upgrade equipment and boost their marketing efforts.

-

After running through hundreds of possible names – including "Paygosaurus," a friendly dinosaur that gives you money – we landed on "cabbage," which is slang for money. We took a little creative license with the spelling, and the rest is history.

-

CEO Rob Frohwein, Chairman Marc Gorlin and COO Kathryn Petralia co-founded Kabbage in 2009 to provide small businesses with funding quickly – an area previously underserved by other lenders. Prior to founding Kabbage, Frohwein was the CEO of LAVA Group, an intellectual property and technology investment bank. Marc Gorlin is a seasoned entrepreneur who co-founded companies including Pretty Good Privacy (PGP) and VerticalOne Corporation. With fifteen years in the credit and payments industry, Kathryn Petralia previously served in executive positions at CompuCredit and Revolution Money where she was Vice President of Strategy. Kabbage is venture funded and backed by leading investors including Reverence Capital Partners, SoftBank Capital, Thomvest Ventures, Mohr Davidow Ventures, BlueRun Ventures, the UPS Strategic Enterprise Fund, ING, Santander InnoVentures, Scotiabank, and TCW/Craton.

-

You can email us at support@kabbage.com; call us at 888-986-8263; or connect with us on Facebook, Twitter, Instagramor LinkedIn.