AUTOMATED ACCOUNTING FOR AMAZON SELLERS IN QUICKBOOKS

comprehensive solution for QuickBooks Online, Desktop and Enterprise to import and automatically reconcile all Amazon Seller Central transactions: orders, refunds, fees, reimbursements, etc, saving hours of your time

FULLY AUTOMATED ACCOUNTING

for both Fulfillment by Amazon (FBA) and Fulfillment by Merchant

READY FOR A FREE TRIAL?

connect your Amazon Seller and QuickBooks accounts

Sign in to Entriwise

Sign in to Entriwise with your existing Amazon or Intuit credentials

Connect to Amazon Seller account

Obtain Amazon MWS credentials to authorize Entriwise to access your Amazon Seller account

Connect and configure QuickBooks

Opt for automatic QuickBooks configuration for Entriwise or configure everything manually

Map Amazon Inventory SKU to QuickBooks

Map Amazon SKU to QuickBooks automatically by following Entriwise convention or do it manually using Web UI or CSV files

WHY ENTRIWISE?

Many Amazon Sellers are frustrated with the time, effort and money it takes to perform proper accounting for their business. We created Entriwise to dramatically reduce this burden.

Entriwise is not yet another tool that only scratches the surface of your problems. Our goal is to fully automate your entire Amazon Seller accounting preserving all important transaction details.

Entriwise is quick and easy to set up to address a major chore of all Amazon Sellers: ensuring proper accounting for Amazon Seller Central transactions in QuickBooks to facilitate correct and compliant financial and tax reporting.

Success of our customers directly translates into our success. To this end, we always listen to your feedback to improve our service every day.

AMAZON ACCOUNTING IN QUICKBOOKS

benefit from fully automated accounting for all Amazon transactions types and Amazon statement reconciliation.

AMAZON SALES AND REFUNDS

Import Amazon orders and refunds using accrual accounting method to ensure that imported transactions correspond to Amazon Statements

- Sales Records : record all important data, such as date, Amazon order ID, name, quantity and price of products sold, rebates, charges, etc

- Amazon Orders : import shipped Amazon orders (FBA, non-FBA / FBM) as relevant sales documents into your accounting software to record each sale

- Amazon Refunds : import refunded Amazon orders as relevant accounting documents to properly account for each refund

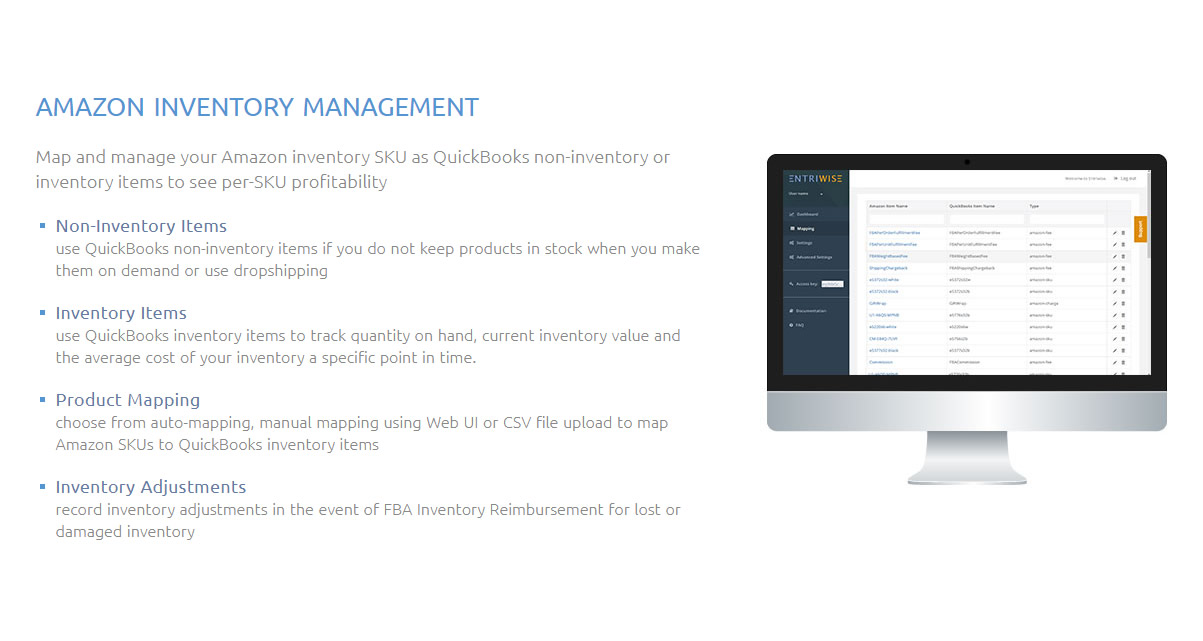

AMAZON INVENTORY MANAGEMENT

Map and manage your Amazon inventory SKU as QuickBooks non-inventory or inventory items to see per-SKU profitability

- Non-Inventory Items : use QuickBooks non-inventory items if you do not keep products in stock when you make them on demand or use dropshipping

- Inventory Items : use QuickBooks inventory items to track quantity on hand, current inventory value and the average cost of your inventory a specific point in time.

- Product Mapping : choose from auto-mapping, manual mapping using Web UI or CSV file upload to map Amazon SKUs to QuickBooks inventory items

- Inventory Adjustments : record inventory adjustments in the event of FBA Inventory Reimbursement for lost or damaged inventory

AMAZON ORDER AND REFUND FEES

Account for expenses associated with Amazon order and refund fees to see your preliminary Amazon net income

- Order Fees : Amazon order fees charged for each Amazon order, including Referral Fee on Item Price, FBA fulfillment fees, shipping chargebacks, etc

- Refund Fees : fees, refunded and charged, associated with each Amazon refund, including refunded Amazon order fees, FBA refund and return fees, etc

- Advertising Fees : Amazon Sponsored Products advertising charges and credits

AMAZON OTHER TRANSACTIONS

Account for the remaining Amazon transactions to see your final Amazon net income and statement balance

- Product Preparation & Shipping Fees : Amazon partnered carrier and inventory placement service fees, including shipping services purchased from Amazon

- Inventory Storage & Removal Fees : storage, return and disposal fees charged by Amazon for storing, managing and removing your inventory

- Other Charges and Credits : FBA inventory reimbursements, balance adjustments, etc

AMAZON STATEMENT RECONCILIATION

Once Amazon statements become available, automatically reconcile transactions imported by Entriwise

- Amazon Statements : benefit from completely automatic reconciliation with Amazon statements, saving hours of your time from manual location and elimination of accounting discrepancies

- Form 1099-K : rely on QuickBooks accounting records automatically reconciled with Amazon statements to prepare quartely and yearly tax reports matching Form 1099-K sent by Amazon to the IRS