Fast funding for your business. No paperwork.

Flexible business lines of credit and invoice factoring. Credit lines up to $2.5M. Cash in as fast as 1 day.

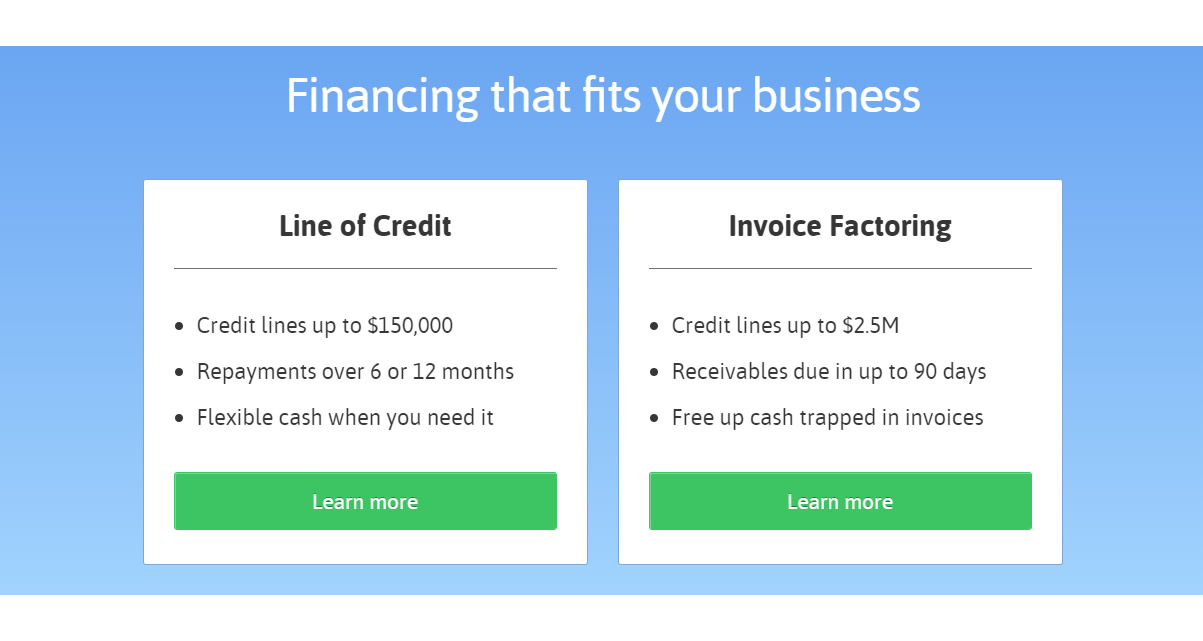

Line of Credit

A fast and flexible business line of credit

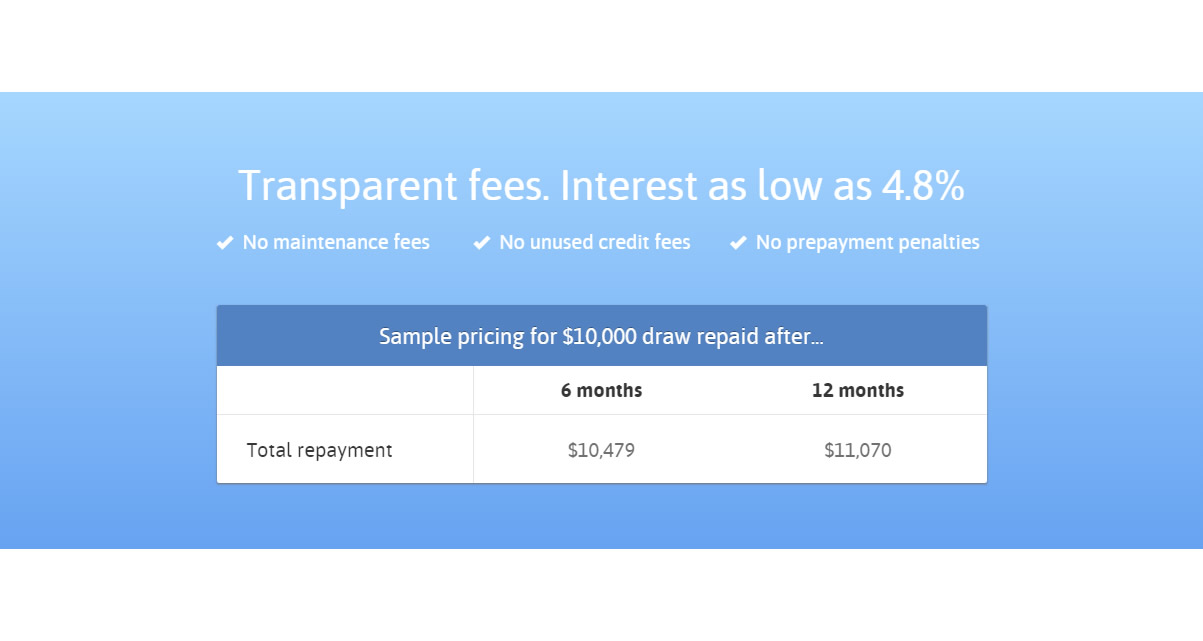

Get the security of a true revolving line of credit up to $150K.Draw whenever you want, pay only for what you use.

Fast cash, always there for you.

- Get approved in 24 hours

- Draw funds whenever you need

- Available credit replenishes as you repay

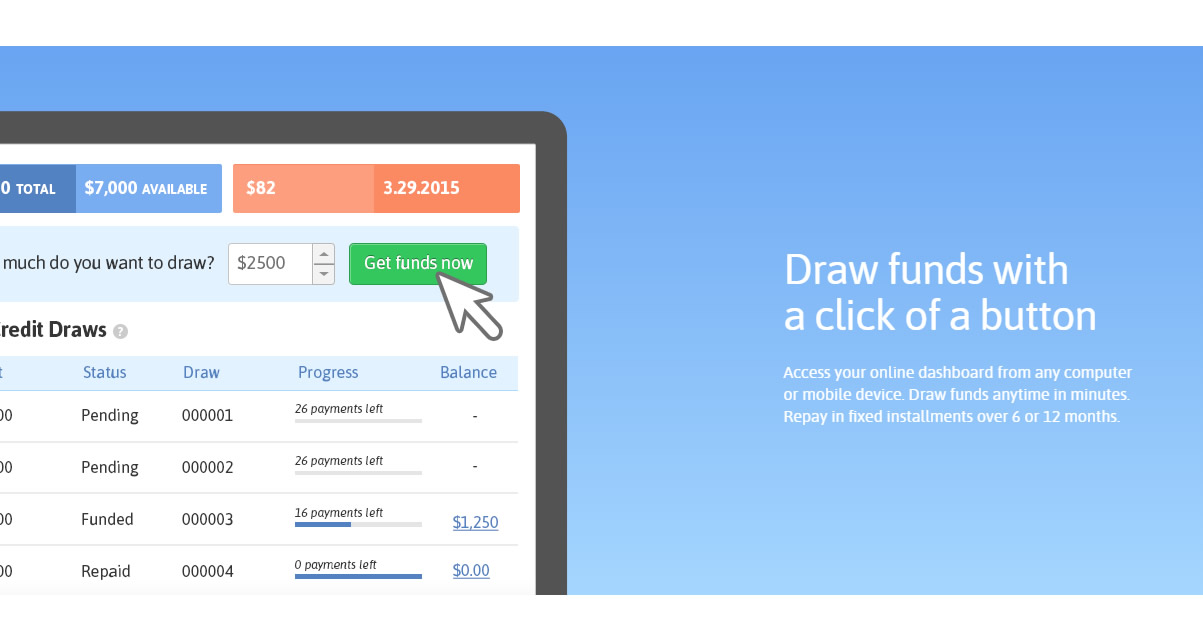

Draw funds with a click of a button

Access your online dashboard from any computer or mobile device. Draw funds anytime in minutes. Repay in fixed installments over 6 or 12 months.

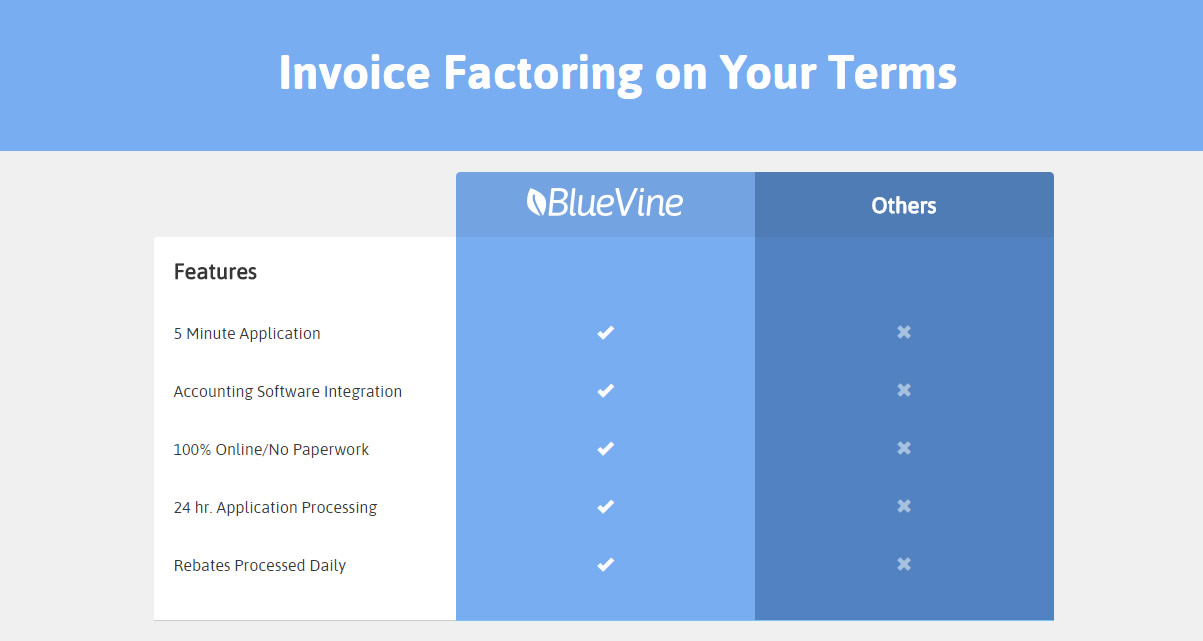

Invoice Factoring

Fast and simple invoice factoring. No paperwork.

Get an immediate advance on your outstanding invoices. Credit lines from $20,000 to $2.5M. Cash in as fast as 1 day.

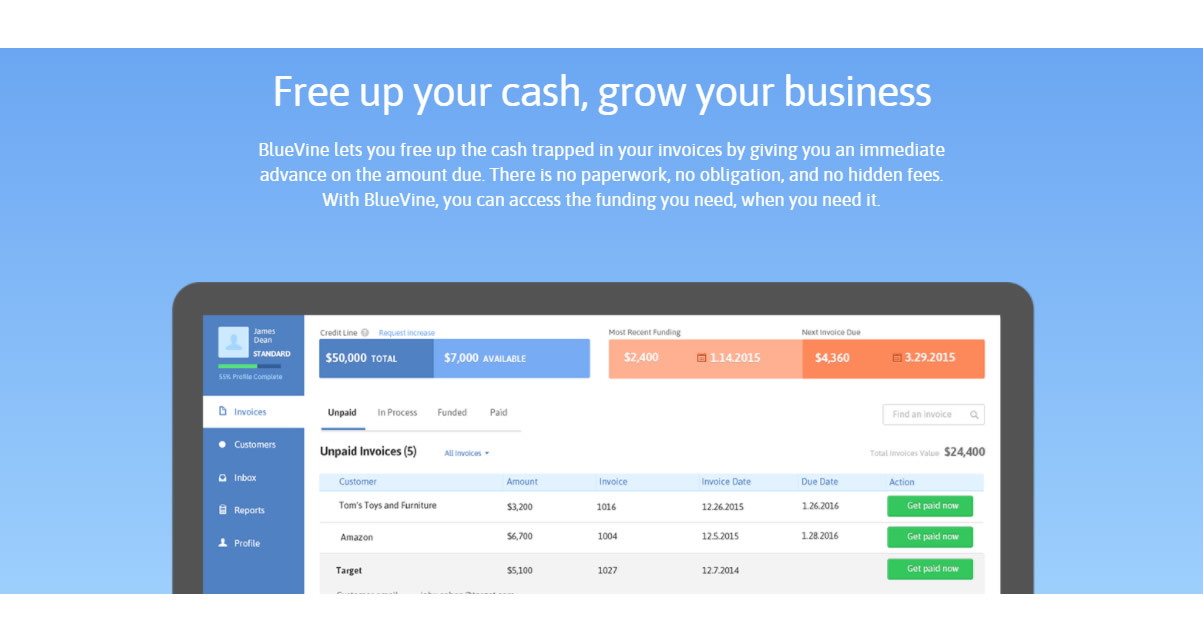

Free up your cash, grow your business

BlueVine lets you free up the cash trapped in your invoices by giving you an immediate advance on the amount due. There is no paperwork, no obligation, and no hidden fees. With BlueVine, you can access the funding you need, when you need it.

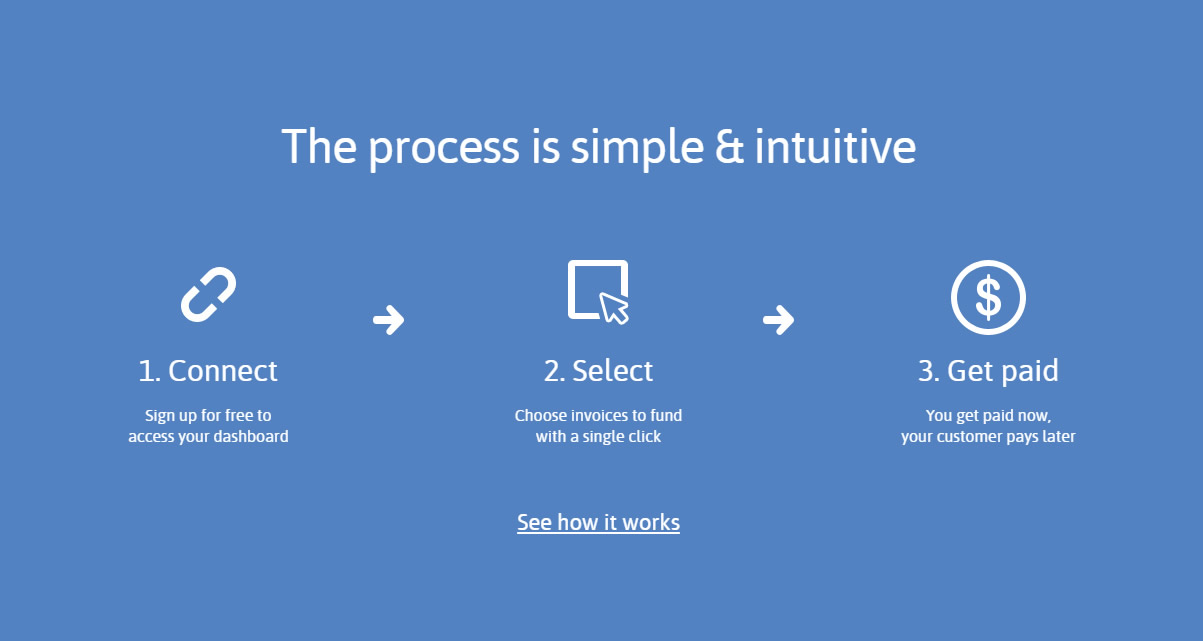

The process is simple & intuitive

Connect

Sign up for free to access your dashboard

Select

Choose invoices to fund with a single click

Get paid

You get paid now,your customer pays later

FAQ

-

What is BlueVine?

BlueVine is a leading online provider of working capital financing to small businesses. We offer financing through our business line of credit or invoice factoring products. We believe in making business financing fast, simple, and transparent so business owners like you can spend your time growing your business, not managing your cash flow.

-

What are the benefits of using BlueVine?

-

Speed: we generally approve applications within 24 hours, and after that we can get you funds as fast as a few hours after your request

-

Simplicity: a 5 minute application and an intuitive online dashboard

-

Transparency: when approved, we give you one rate for line of credit draws or factored invoices. As long as your account is in good standing, this includes everything except the optional wire transfer fee ($15)

-

Flexibility: fund only when you need, and pay only for what you use

-

Personal Service: a US based customer success team ready to answer any question or help with any issue

-

-

Do I need invoicing or accounting software to use BlueVine?

No. Connecting your invoicing or accounting software to your BlueVine dashboard provides some additional benefits, but you can use BlueVine even if you don’t use invoicing or accounting software.

-

What are the benefits of connecting my invoicing or accounting software?

-

You may qualify for a higher credit line.

-

If you use QuickBooks, applying using your Intuit credentials at sign-up shortens your application process by pre-filling application fields.

-

If you use BlueVine’s invoice factoring, invoices sync from your software for one-click funding.

-

-

What information do you need from me to apply?

The BlueVine application is three simple steps that can be completed in minutes.

We ask for:

-

General information about your business, such as address and Tax ID

-

Information about the business owner applying, including social security number

-

Either a read-only connection to your business’ bank account or your 3 most recent months of bank statements

The information you provide is stored in accordance with our strict Privacy Policy and encrypted to make sure that it is always safe and secure. -

-

How is qualification for a BlueVine account determined?

Qualification for BlueVine is determined based on a number of factors. These factors include, but are not limited to, your business cash flow, the strength of your customers, and to a lesser extent your personal and business credit history. You do not have to have perfect credit to work with us. We work with a broad range of clients, including those with below average credit.

-

What kind of credit score must I have to apply for a BlueVine Account?

While we evaluate many parameters when making a funding decision, we look for personal credit scores above 530 for our invoice factoring service and above 600 for our business line of credit service.

-

How quickly does BlueVine make funding decisions?

We typically respond to your application within 24 hours.

-

How much funding will I have access to?

BlueVine offers credit lines between $5,000 and $2,000,000. Your credit line is the total amount of funding that you can have outstanding at any given time, and will replenish as you repay draws (for a line of credit) or as your customers pay outstanding invoices (for invoice factoring).

-

Are there termination fees if I want to leave?

No. As long as you have no balances outstanding, you can stop using BlueVine at any time with no penalties or fees.

-

Does BlueVine provide unsecured financing?

BlueVine financing is not unsecured. However, we do not require any specific amount, type or value of collateral and no appraisal or specific assets are required. Financing is secured by a general lien on the assets of the business and backed by a personal guarantee. We do not take personal assets as collateral.