WELCOME TO SIMPLY VAT.com

Helping E-Commerce Trade Internationally.

What We Do

VAT Registrations – Made Simple

EU Based Online Retailers

Selling goods online to customers in other European countries will require compulsory VAT registration if your sales exceed certain VAT Registration Thresholds which differ from country to country.

Non-EU Based Online Retailers

If you are based outside the EU, you can elect whether you or your customer is the ‘importer of record’ [who the importer of the goods actually is and therefore who is responsible for the import charges]. If you make your customer the ‘importer of record’, your customer will be responsible for all import charges relating to the purchase. Many sellers experience large volumes of returns when shocked customers refuse to take delivery of their purchases because of unexpected import charges applied on the delivery of their item.

If you choose to be the ‘importer of record’ as the seller, rather than your customer, you should VAT register in the first European country where your goods land. Thereafter, selling into Europe will be subject to the same distance selling VAT Registration Thresholds as those companies already based in Europe.

The non-EU online retailers who are voluntarily registering for VAT, experience a big fall in returns and give their customers a much better buying experience.

Summary

Non-compliance for any online retailer can lead to penalties and fines.

SIMPLYVAT.com can provide you with a VAT registration in any relevant country.

If your sales fall below the registration threshold or you cease to trade in that country you can deregister. SIMPLYVAT.com will process the deregistration for you.

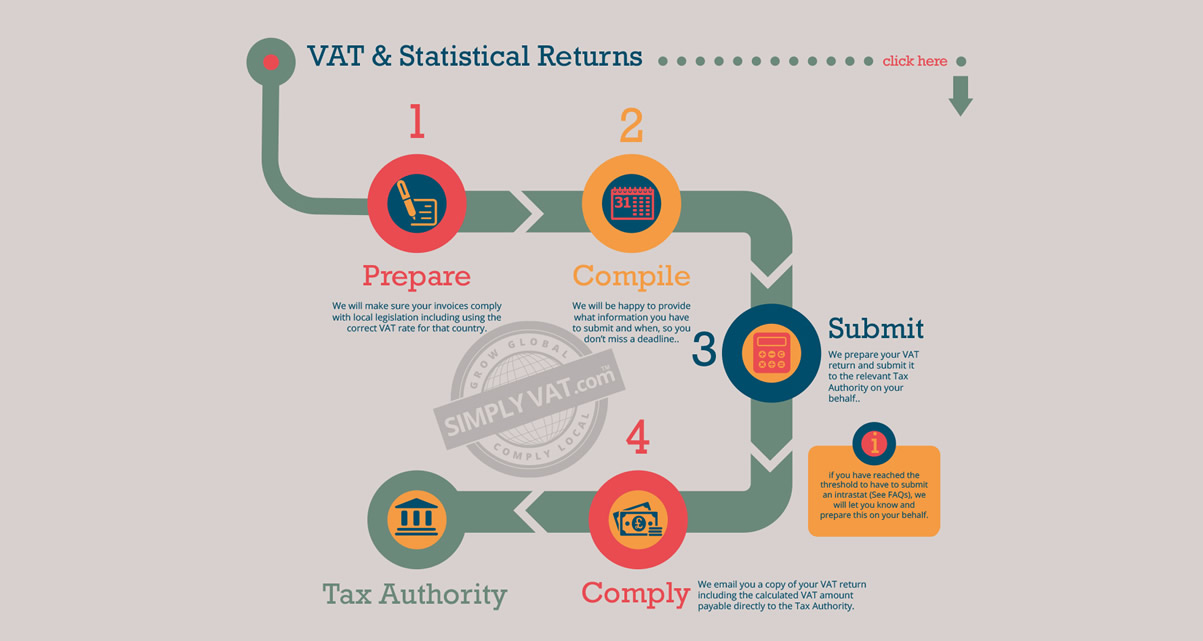

On-going VAT Compliance– Made Simple

Once VAT registered, there are periodic VAT data requirements necessary to fulfil local tax authority criteria.

SIMPLYVAT.com helps you by collating the required data from you and submitting it on your behalf in the relevant local language.

An Intrastat is a statistical return is used by European governments to collect information on the movement of goods between EU countries. They only want this information when sales reach or exceed set Intrastat Reporting Thresholds (which differ from VAT Registration Thresholds). Non-compliance is a criminal offence. SIMPLYVAT.com can help you meet your mandatory obligations.

SIMPLYVAT.com international VAT compliance processes helps you grow your businesses:

The Benefits

Your goods are approved by the local tax authorities

Your goods get to your customers on time and on budget

Your customers pay no extra import charges

Your business cash-flow remains assured

Your business avoids any potential regulatory penalties and fines

Your compliant global reach increases your selling opportunities

Cuurency

Foreign Exchange

The Real Benefits of Using a Foreign Exchange Company

It’s a competitive world out there – keeping your operations lean will give you a competitive edge.

Beware the currency pitfalls; their hidden costs can turn overseas profits into unforeseen losses. An easy area to succeed in not wasting your money is to use a foreign exchange company

You can Beat the Banks by up to 4% on overseas money transfers!

As an e-tailer, you need a straightforward, cost-effective way to make or receive payments overseas – and to get the best deal when it comes to converting your funds into your home currency. You don’t have access to the specialist resources that large multinationals have available in-house, but you still need to find a way of making the markets work for you – without spending every spare minute in front of a screen. An experienced foreign exchange provider will take the time to understand your business, its processes and objectives, in order to identify how you might be exposed to FX risks and give you the tools best suited to protect against them.

Currencies Direct are a foreign exchange company which offer a wide range of products that help online retailers save money in an increasingly competitive environment. Contact Currencies Direct to find out how they can start saving you money today.

Introducers

Are you looking to differentiate your business, add value to your customers and gain new revenue streams?

We work with introducers in a variety of industries, from accountants to solicitors, to web designers and e-commerce platform providers, and from payment solutions to logistic companies.

Do you have contacts or clients who sell goods online and abroad?

Introduce your contacts to SIMPLYVAT.com and you:

Give them access to over 15 years of international VAT expertise.

Help them Grow Global and Comply Local.

Our PROMISE to you – we will be RELIABLE, RESPONSIVE and TRUSTED, looking after your clients properly from start to finish.

If you would like to join our Introducer scheme, please contact: affiliate@simplyvat.com. There is no charge to join, just the opportunity to earn commission from us for every successful referral.

VAT FAQs

What is ‘VAT’?

VAT (Value Added Tax) is a form of consumption tax.

All 28 European countries have VAT. It has different names in different countries eg. In France it is TVA, Spain – IVA, Germany – Mwst, etc. Each country also applies its own VAT rate. VAT is a key source of revenue for any government.

How is VAT collected?

The seller charges VAT to the customer and the seller pays over this VAT to the government.

Why should I register for VAT?

You may be legally required to do so. If you do not comply, the tax authority can fine you and in some cases stop your goods getting to your customers. Find the VAT Registration Thresholds for 2017 here

What is a VAT PACK?

We send you a SIMPLYVAT.com VAT PACK – A registration pack for the country(ies) you need to register in. The pack contains a list of the documents you will need to send to us in order for us to register you. Standard documents can include copy of Certificate of Incorporation and Power of Attorney.

How long will it take for me to get an international VAT registration number?

Once we have all the paperwork it can take up to 6 weeks to receive a VAT registration number.

How much will it cost?

Prices vary depending on which country you need to register in. Please contact us for a quote on 01273 634594 or email us on info@simplyvat.com.

What happens once I register?

Once VAT registered, there are periodic VAT data requirements (VAT Returns and Intrastat) necessary to fulfil local tax authority criteria. We help you by collating the required data from you and submitting it on your behalf in the relevant local language. Please refer to our VAT Returns page.

De-registration – what if I don’t want to be registered for VAT any longer?

We can help you work out if you are eligible to de-register in the country(ies) you don’t want to be registered in. If you are selling over that country’s VAT threshold you will have to continue to be registered and file periodic VAT returns. If, however, you are eligible, we will deregister you in the relevant country(ies).

What if I don’t get the information you need to compile the VAT returns to you on time?

If we don’t get the correct data sent to us in time, the tax authority can issue penalties or fines that you will have to pay in addition to any VAT you owe.

How often will I have to submit a VAT return?

This depends on which country you are registered in. Some countries will ask for VAT returns each month, others – quarterly or even bi-monthly. We will let you know as soon as we know which countries you need to register in.

What do you mean by ‘statistical returns’?

A Statistical return is an ‘Intrastat filing’. This document is the method used by European governments to collect information and produce statistics on the movement of goods between Member States in the European Union (EU). These have different thresholds to VAT.

Find the Intrastat Reporting Thresholds for 2017 here

Do you have an introducer programme?

Yes we do and we would love the opportunity to work with you. Every sale we make through you will be rewarded. Please go to our Introducer page to read more or contact us on Introduce@simplyvat.com.