FBA Scorecard

How does your business compare against other businesses that have already sold in 2018?

Our scorecard will give you a ballpark valuation for your business (no need to reveal brands/products) as well as tips to improve the value based on your answers… just fill in the below to get your results.

How To Sell An Amazon FBA Business

“Can I sell my FBA business?”

This is often the first question I hear from clients… unfortunately the answer is, it depends.

My name is Coran Woodmass and I’m The FBA Broker. I help people just like you prepare and then sell their Amazon FBA businesses.

Even though each business is different there are some factors that will make it easier or harder to sell your business.

In this post I’m going to show you 3 ways to determine if you could sell your FBA business and if so what it is worth now, but also what makes it worth MORE.

We’ll discuss strategies whether you should hold and improve or sell and cash out now!

Deciding to sell then raises a whole of new bunch of questions such as who would buy your business, where do you find them and what’s the sale process like?

These questions and many more common hurdles when selling are all explained in the coming sections.

Here’s an outline of what we’ll be discussing:

- Can I sell my FBA business?

- What is my FBA business worth?

- What can make my business worth more?

- Should I sell my FBA business now or hold it?

- Who would buy my business?

- How do I find a buyer?

- How long will it take?

- Common Hurdles

- Questions from sellers

To begin it helps to look at your business through the lens of the buyer, without a buyer your business could be listed for sale, but never sell!

Can I sell my FBA business?

Here are 3 things to help you determine if you could sell your business:

- Type of business

- Age

- EBITDA (annual net profit)

Each of them play an equally important role when determining saleability. These are what any buyer will be assessing. So let’s look at them in more detail.

1. Type of FBA business

- Reseller

- Private Label

- Proprietary Products

Reseller

You compete for the buy box. You buy wholesale and make a margin selling retail on Amazon. The is sometimes referred to as retail arbitrage.

This type of businesses range from hard to sell to impossible to sell, even if you are making a good amount of profit. There are a number of reasons this style of FBA business is less attractive to a buyer.

- It’s highly volatile – there is often no limit to the amount of competition.

- Supply can be a problem.

- Nothing proprietary – a buyer is really only buying access to your seller central account.

Note: If you have exclusive contracts with wholesalers to sell on Amazon this could make your business easier to sell as it would be more attractive to buyers.

Private Label

You have your own brand but other people can buy the same product elsewhere. This type of business has some leverage and can be more attractive to buyers.

Proprietary Products

For example a supplement where you created the formula or a popular product you have made better and it’s unique to you and your brand.

This is the gold standard as only your company sells this specific item. Buyers will often pay a premium as this makes your business more defensible long term.

2. Age

A buyer will want to know over what period your business has performed to estimate how long it will take to make their investment back. Basically the longer the history the better. You can sell a business that is under one year old for instance, but a buyer will want a discount for taking the risk of not knowing how a full calendar year will impact sales. The risk here is not seeing seasonality in sales.

3. EBITDA (Annual net profit)

You need to know your numbers. The buyer will use a multiple of your annual net profit (also called EBITDA earnings before interest, tax, depreciation and amortization) to formulate an offer for your business. In other words the offer for your business is directly related to your net profit. Having your books up to date is critical and is usually the biggest hurdle to getting your business listed for sale, and ultimately sold!

When a buyer is looking at your P&L (Profit & Loss Statement) they will look for trends. For example, are your products seasonal, are sales trending up, down or steady. Savvy buyers will also look at your Amazon BSR to get a sense of where your business is trending as a whole.

Now that we know the type of business, age and EBITDA criteria a buyer will be looking at, we can we use this to determine a sale value.

What is my FBA business worth?

Unfortunately you will not know the true value of your FBA business until someone buys it. What I can help you work out is an estimate of what your FBA business could sell for…

There are many factors to take into consideration, as a rule of thumb take your annual net profit, this is known in investment circles as EBITDA and multiply this figure by 2.

Estimated sale price = EBITDA x 2 e.g. say your EBITDA is $100k your business could be worth around $200k.

Keep in mind on top of the sale price a buyer will purchase your inventory at cost (including the cost to get the inventory into the FBA warehouses).

When valuing a business it helps to look at historical sale transactions to compare market trends. In 2015, of 15 FBA businesses sold, the average multiple an FBA business sold for was 1.83 times EBITDA, the average deal size was $180k and the total value of these deals was just over $3.1M.

What can make my business worth more?

The good news is that there are things which you can do to make your business more valuable to a buyer. Here are 6 factors which can make your FBA business worth more:

- Type of FBA business

- Age

- EBITDA

- Defensibility

- Diversification

- Competition

Even though we’ve touched on the first three already let’s look at them through a hierarchy of value mindset for the buyer.

1. Type of FBA business

The hierarchy of value with an FBA business looks like this:

- Unique product and brand – for example supplements that are a custom formula

- Private label (unique in some way is better than label on same product)

- Reseller – these businesses are super risky and even unsellable in most cases

2. Age

The hierarchy of value compared to age looks like this:

- Over 3 years – great

- 1-2 years – good

- Under 1 year – not great, expect low-ball offers

The difference in the age of your business will be reflected in the offer (multiple of EBITDA) from a buyer.

3. EBITDA (Annual net profit)

First off you need to be making an actual profit.

It’s best to use accrual accounting to figure out if you are profitable each month. I often talk with business owners who believe their net profit each month is up to double what it actually is once they fill in a proper profit and loss statement.

The level of profit will shape the type of buyer who is attracted to your listing.

For example one typical buyer type is a corporate executive who is looking to replace a low-mid 6 figure salary. So for him buying a business only making a couple thousand a month won’t put much of a dent in his goal. He might instead look at a business already making 6 figures a year in profit.

As a rule of thumb we like to deal with businesses that are making over $100k minimum in net profit per year.

4. Defensibility

How easily could a competitor enter your market with a similar product and take your market share away? This can be a hard question to answer, so let’s break it down.

Are you selling garlic presses with a ton of sophisticated FBA sellers all jostling for the top spot? A ton of sophisticated FBA competitors could scare off buyers. As the chance of someone taking over your position and your sales dropping overnight are high.

On the opposite side of the scale, if you hold a patient for your product this adds value to the business and could see your multiplier increase.

5. Diversification

Diversification can give your valuation and offers you receive a real boost!

Levels of diversification:

- Products, niches and traffic sources (outside of Amazon)

- Niches and traffic sources

- Just one form either products, niches or traffic

All buyers look to minimize their risk. The biggest risk with Amazon is account suspension, next is losing rankings within Amazon. If you can prove how your business will continue if either of these worse case scenarios occurs it will give the buyer peace of mind and increase the chance of your business selling and possibly result in higher offers as well.

If you want to diversify your business here are some action steps you can take TODAY:

- Add traffic sources outside of the Amazon ecosystem, from your website, social media platforms, email marketing etc.

- Aim for not more than 70% of your income from one product or niche.

- Have multiple products in multiple niches.

- Profitable paid traffic within Amazon (sponsored ads/PPC) is a great thing to have.

6. Competition

Do you have a ton of sophisticated FBA sellers as competition e.g. iPhone cases? This can scare off buyers. If there is a high chance that you will lose your rankings overnight this means your income will drop just as fast.

Buyers are aware of this possibility and any offers, or lack of offers you receive, will reflect the perceived risk of buying your business.

If only one or two of your products have this issue but you’re diversified this can help mitigate the risk in the eyes of the buyer. If you have not done this yet, start here!

So, Should you sell your FBA business now or hold it?

This is a great question, one I ask myself as well before selling any income producing asset. I like to asses a number of things before considering to sell. Here is my personal thought process that might help:

- What else am I working on, is something else more exciting?

- Am I finding managing the business a chore?

- Could I roll the capital from the sale into a new venture?

- Do I just want the security of more cash in the bank?

If you answered yes to 1 or more of these questions, it might be a good time to sell!

If you answered no to all of the questions, holding is probably best.

However if you’re working on something more exciting which has your focus and it’s impacting the profitability of your FBA business then this can hurt you. Selling a business in decline will only result in 1 thing, low ball offers! We never recommend selling at this time. This is when you should hold, fix the broken link and get the multiple your deserve.

So now it’s time to sell, the nest question on your mind would be…

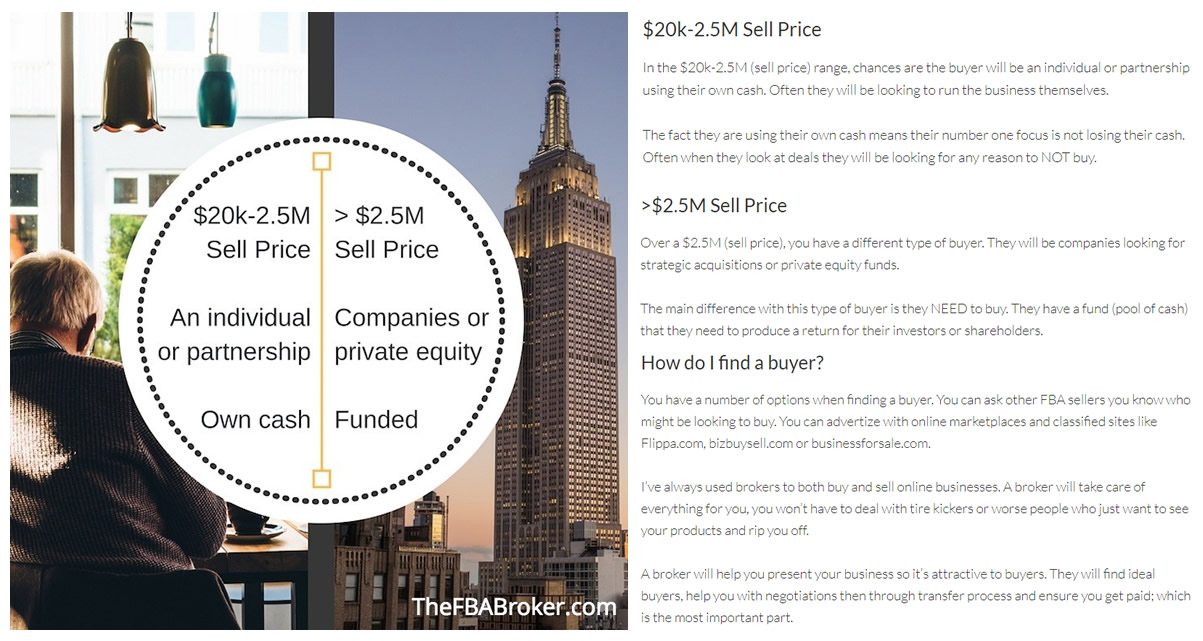

Who would buy my business?

There are many different types of buyers, however I like to look at this from a high level view.

$20k-2.5M Sell Price

In the $20k-2.5M (sell price) range, chances are the buyer will be an individual or partnership using their own cash. Often they will be looking to run the business themselves.

The fact they are using their own cash means their number one focus is not losing their cash. Often when they look at deals they will be looking for any reason to NOT buy.

They want to buy a business, however their primary driver is fear of loss.

This type of buyer is looking for the best deal available in their price range. Hence the focus on more established and defensible (proprietary product, own brand) businesses.

Often these buyers will be new to selling on Amazon or even to online business/marketing as a whole. Typically they are cashed up retirees, high paid executives or investors with multiple businesses looking for stable income and better returns on their capital than a bank or mutual fund can provide. For the most part they are NOT looking for a full time job, so the less time it takes to run your business the better.

That said, there are a number of online marketers, e commerce business owners and FBA sellers looking to acquire other FBA businesses as well.

>$2.5M Sell Price

Over a $2.5M (sell price), you have a different type of buyer. They will be companies looking for strategic acquisitions or private equity funds.

The main difference with this type of buyer is they NEED to buy. They have a fund (pool of cash) that they need to produce a return for their investors or shareholders.

Often these buyers want larger businesses, $5M EBITDA and above. As they have large funds that need a return, buying smaller businesses just won’t move the needle on investor returns.

How do I find a buyer?

You have a number of options when finding a buyer. You can ask other FBA sellers you know who might be looking to buy. You can advertize with online marketplaces and classified sites like Flippa.com, bizbuysell.com or businessforsale.com.

I’ve always used brokers to both buy and sell online businesses. A broker will take care of everything for you, you won’t have to deal with tire kickers or worse people who just want to see your products and rip you off.

A broker will help you present your business so it’s attractive to buyers. They will find ideal buyers, help you with negotiations then through transfer process and ensure you get paid; which is the most important part.

Depending on your profit levels a broker will charge a percentage of the sale price ranging from 15% on smaller deals and 10% on larger deals.

Whether you’re selling to a high paid executive or a private equity fund next you’ll need to find your buyer.

How long will it take?

It really depends on your business and how well it matches the criteria of buyers. Even if your business is a perfect fit for a buyer, it can take weeks or months to close the deal.

Remember most buyers are afraid of loss first and foremost, so they will be spending a ton of time on due diligence to find the one reason to NOT buy your business and save their capital for another deal.

As a benchmark:

- Smaller business <$500k can sell within 90 days

- Businesses >$500k can take longer

- Larger businesses over $1M can take longer again, can be more complex and require more due diligence

And of course with any of these sales there are always common problems that arise. Getting ahead of them now can reduce a lengthy draw out sale.

Common Hurdles

- Books – need to be 100% accurate.

- Suppliers – easy to deal with and reliable?

- Calls with buyers – You need to be available to talk with buyers. It’s rare to sell a business for $100k + without speaking to the buyer. They want to meet you and hear from you about the business.

- Questions from buyers – Again there will be a number of questions from legitimate buyers that you will need to respond to. A proper prospectus will help ahead of time but you will still need to answer questions as they come up.

- Preparing prospectus – Do the work upfront!

Whilst preparing for the sale is the hard part, selling the business is ultimately the end goal and the work will be worth it. So that you’re prepared with what’s to come, let’s talk thought the sale process from transfer the site to getting paid.

How do I transfer my business?

The best way to transfer an Amazon FBA business is to transfer the whole seller central account to the new owner. It’s cleanest and fast way possible. You don’t need to move stock or anything. Simply change the EIN, address and bank details for the account over and you’re good to go.

A buyer will also pay for stock at the time of transfer for cost, including shipping into the warehouse.

How do I get paid?

We advise our clients to use an escrow service (often the broker can assist with this also) escrow.com is a popular choice as a third party supplier.

This way the cash is held by a third party and only once both sides are happy the transaction is complete do the funds get released by wire transfer to your bank account.