BEST SOLUTION FOR INVOICES ON AMAZON

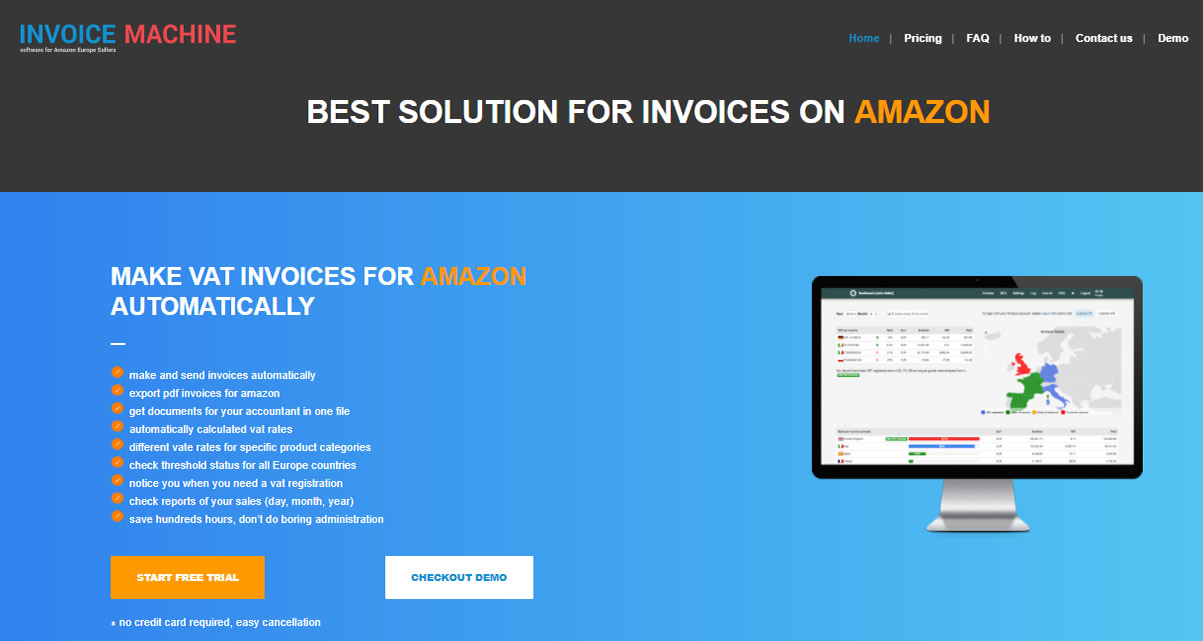

MAKE VAT INVOICES FOR AMAZON AUTOMATICALLY

- make and send invoices automatically

- export pdf invoices for amazon

- get documents for your accountant in one file

- automatically calculated vat rates

- different vate rates for specific product categories

- check threshold status for all Europe countries

- notice you when you need a vat registration

- check reports of your sales (day, month, year)

- save hundreds hours, don’t do boring administration

IT’S LIKE A MAGIC

Every morning invoices are sent out automatically to your amazon customers for all orders with proper order ID, invoice number, vat number, vat rates for every country and currency exchange rates. It calculates your VAT and thresholds per country. When you need a vat registration, notice you. Everything consistent with an actual legal regulation.

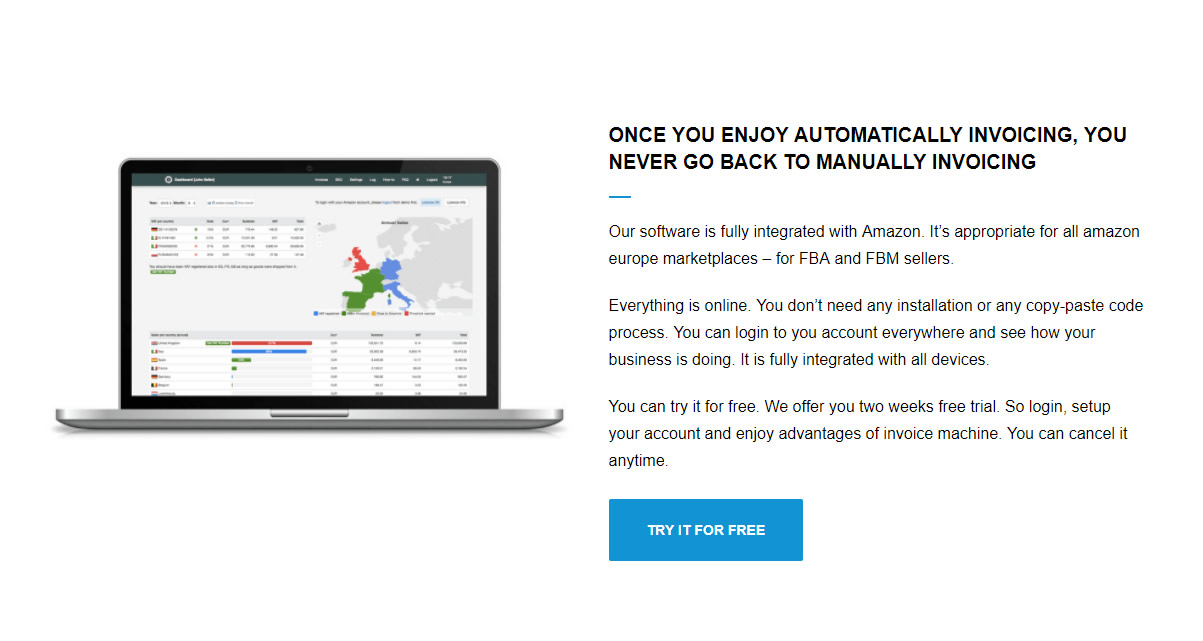

ONCE YOU ENJOY AUTOMATICALLY INVOICING, YOU NEVER GO BACK TO MANUALLY INVOICING

Our software is fully integrated with Amazon. It’s appropriate for all amazon europe marketplaces – for FBA and FBM sellers.

Everything is online. You don’t need any installation or any copy-paste code process. You can login to you account everywhere and see how your business is doing. It is fully integrated with all devices.

You can try it for free. We offer you two weeks free trial. So login, setup your account and enjoy advantages of invoice machine. You can cancel it anytime.

WE HELP YOUR BUSINESS TO GROW

It’s great feeling to sell products on Amazon. After that doing unprofitable administration isn’t so great. Our software do it for you. Whether you have 10 orders or 1 000, it doesn’t take you more time to make and send invoices. Our software do it for you. With growing your business, doesn’t grow your worries with invoices.

We help you develop your business and make more money. You can give this time to activities which make your business to grow.

Look inside our software. Checkout demo and you will see how our system works. It can help you to make a choice.

FEATURES

We update our system all the time because we want to bring you the best services. There are some of the features you can find when you login. If you have ideas for new one, let us know.

System automatically generate invoices with your logo, company data, customer data, invoice number, vat, etc.

You can setup automatically sending invoices to all your new orders. Or you can send it manually.

All your nice-looking invoices have pdf format. You can download and print it easily.

Everyday you have a fresh data about your sales. You can see how much orders you made daily or monthly.

All data you can export in excel. One analytics report of you sale for you. Second report for you accountant.

You clearly see vat thresholds per country. We notice you when you need a vat registration.

Data are imported automatically twice a day. We keep your data about sales and vat fresh.

The whole time you have our technical support. Don’t be affraid contact us throught email or phone.

Seller return an order back? No problem. Software creates negative invoices for returns too.

You can send a special note to you customers with outgoing invoices. Set it up in 5 different languages.

If you sell products with reduced VAT, you can set up different vat rates for this specific types of product.

Currency exchange rates are calculated automatically. They are downloaded online from ECB and HMRC.

INSTANT ANALYTICS OF YOUR SALE

Do you want to know how many orders you had last quarter or last year?

No problem. Our software show you analytics of your sale. You will see how many orders you made and how much you earned. Price for one year back is 49 €. More than one year – negotiated price. Contact us.

Do you need make invoices backward?

We can help you too. Contact us for price and we send you offer.

All invoices we can import to your dropbox.

It is long tome process to download every invoice separately. Now you can have all your invoices on dropbox. Contact us for price and we send you offer.

WE WILL MAKE YOUR ACCOUNTANT HAPPY AS WELL

You export all important data for you accountant in one excel sheet. It’s so simple how it sounds. You login to your account. Export excel and send it to your accountant. That’s all.

All necessary data are there, including currency rate for every invoice in particular date and VAT calculation in local currency where your VRN is registered. Everything in one clear „easy-to-understand“ document. It couldn‘t be easier.

Your accountant saves time and you save money. It’s win-win.

FAQ ABOUT INVOICE MACHINE FOR AMAZON

vat invoices for amazon europe sellers

It’s a software for Amazon Europe sellers. It creates invoices (vat invoices) from customer’s orders made in any European market (UK, DE, ES, FR, IT). Not only you get invoices to print to PDF & send, it is also your evidence for bookkeeping and VAT accounting.

FOR WHOM IS INVOICE MACHINE USEFUL?

For FBA and FBM sellers in Amazon Europe. For everybody who needs create vat invoices for amazon customers.

IF AMAZON DOES NOT CREATE INVOICES FOR CUSTOMERS, WHY SHOULD I?

Amazon does not make invoices for customer who purchase goods from FBA and FBM sellers. It’s up to sellers. They are responsible for making invoices because they sell goods. European legislation requires to create tax record for any purchase – an invoice.

HOW INVOICE MACHINE HANDLES DIFFERENCES OF INVOICES IN DIFFERENT EU COUNTRIES?

You can set up which of your company data you print on your invoices. All other informations are correct for every country, including VAT, if you are VAT payer.

HOW ARE INVOICES NUMBERED? WHY AMAZON ORDER NUMBER CANNOT BE USED AS INVOICE NUMBER?

In most EU countries it is required to number your invoices in sequence. Amazon order numbers are numbered differently. That why number of order isn’t same as number of invoice.

WHERE DOES MY INVOICES NUMBERING STARTS? CAN I SET UP NUMBERING OF MY INVOICES?

Yes, you can set it up. It starts with first order you import.

WHAT COMPANY DATA SHOULD I ENTER?

Your every invoice should contain data of you company: Company Name, full postal address and if you are VAT payer, then also your VAT number. If you are VAT registered in more then one EU country, then don’t forget to enter all your VAT numbers (Settings). You can upload your logo as well.

HOW CUSTOMER AND ORDER DATA ARE OBTAINED FROM AMAZON?

Automatically via MWS twice a day or manually via CSV import. See How-to.

DO I NEED MANUAL CSV IMPORT?

If you activate MWS, then you don’t need manual import. MWS can be activated only if you have Amazon pro seller account.

HOW ABOUT RETURNS?

Invoice Machine creates negative invoices for returns. (credit note of invoicing)

WHAT DO I SEE IN “THRESHOLD WATCH” TABLE?

You can watch turnover in every EU country of your sales – by shipping address. Once you overrun threshold in particular country, you are required to register for VAT in that country.

WHAT DO I SEE IN “TURNOVER PER VAT NUMBER”?

If you are VAT payer in one or more EU countries, thus you have VAT number in one or more countries, in this table you can see turnover per your VAT number – in other words, VAT you pay to governments of these countries.

There are complicated rules of where you should pay VAT. It depends on countries where you are VAT-registered, on billing and shipping address of every invoice, on warehouse from which the goods has been shipped from, on VAT number of your customer /if he provided it/ and this also depends if your customer VAT number is registered in the same country as your VAT number you have used on invoice, or not.

All these rules are handled by Invoice Machine software so you don’t have to bother with that. Complete data about every invoice and depended data you find in „Accountant Excel“ file, which you can download anytime from Invoice Machine.

WHICH DATE FROM AMAZON ORDER IS TAKEN AS RELEVEVANT FOR INVOICING?

Purchase date.

Invoice Machine monthly totals can be different from Amazon Monthly report, which is caused by different rules Amazon uses to filter orders. Nontheless, Amazon Monthly report should not be used for Income Tax or VAT purposes. Amazon holds no responsibility for your tax reports.

IF MY CUSTOMER ASKS FOR INVOICE, CAN I EMAIL IT RIGHT FROM THE MACHINE?

Yes. Open particular invoice and push „Send PDF“ button. Customer will get invoice right to his Amazon account.

You can search within invoices by customer’s name or Amazon order ID.

WHAT IS “SET BUYER VAT” BUTTON?

If your customer is a VAT payer, then he has his VAT number. This number has to be included in invoice. Amazon does not provide this number in import, so you have to enter it manually via this button. If customer asks for invoice, he will provide you his VAT number. Then VAT rate on your invoice may change, depends on rules. It is calculated by Invoice Machine software.

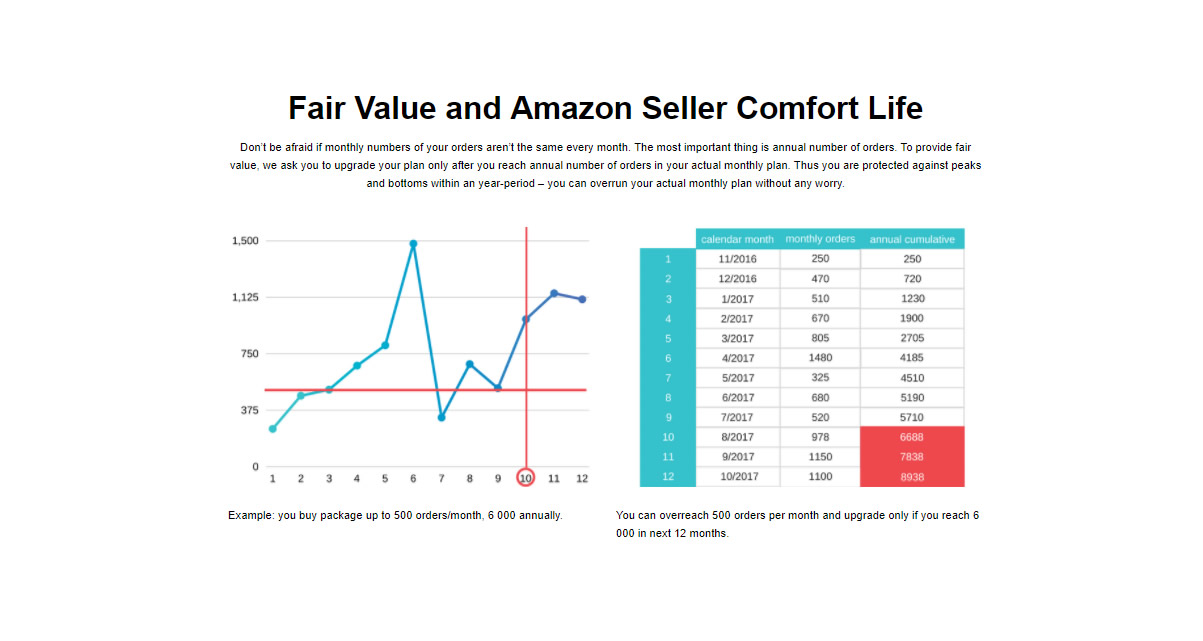

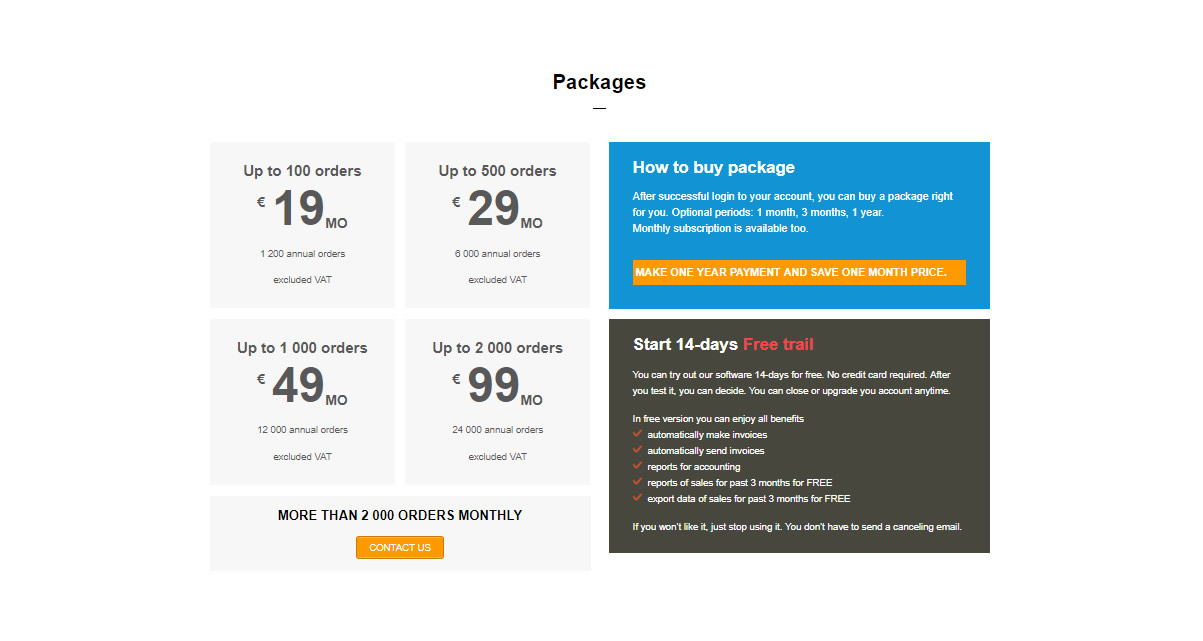

PRICING AND NUMBER OF ORDERS

Pricing is done according to number of your orders. At the beginning, please decide what package you need. In case you reach 90% of the current package, we send you notification that you will need to upgrade it. You can see number of your orders in Dashboard or filter in easily in your Invoices section.

WHAT IS “ACCOUNTANT EXCEL”?

It is a complete data about every invoice. It is needed for your accountant as a foundation for VAT reports, Income Tax reports etc.