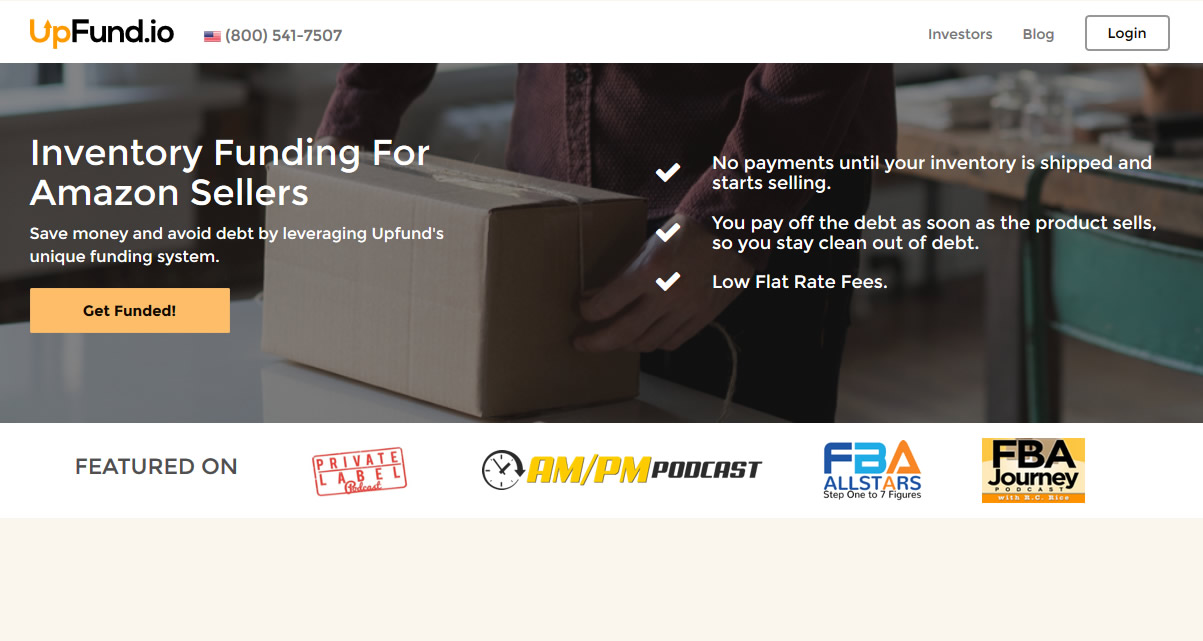

Inventory Funding For Amazon Sellers

Save money and avoid debt by leveraging Upfund’s unique funding system.

- No payments until your inventory is shipped and starts selling.

- You pay off the debt as soon as the product sells, so you stay clean out of debt.

- Low Flat Rate Fees.

Upfund’s Unique Solution

Unlike traditional lenders, UpFund requires you to start paying back only after you've started selling your inventory. This prevents you from having to borrow more than you need and keeps you out of debt.

We understand you need to maintain inventory levels on Amazon, so the Upfund system allows you to pick up more funds for the next round of inventory purchases as soon as sales start rolling in from the first, no refinancing required.

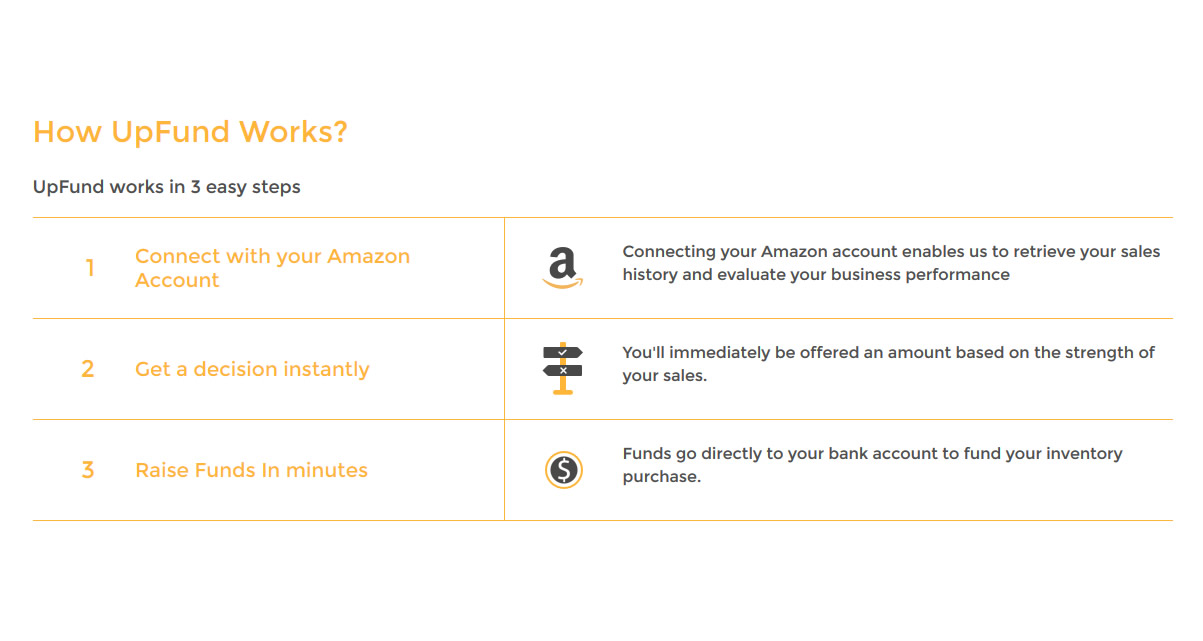

How UpFund Works?

UpFund works in 3 easy steps

Connecting your Amazon account enables us to retrieve your sales history and evaluate your business performance

Get a decision instantly

You’ll immediately be offered an amount based on the strength of your sales.

Raise Funds In minutes

Funds go directly to your bank account to fund your inventory purchase.

Common questions and support documentation

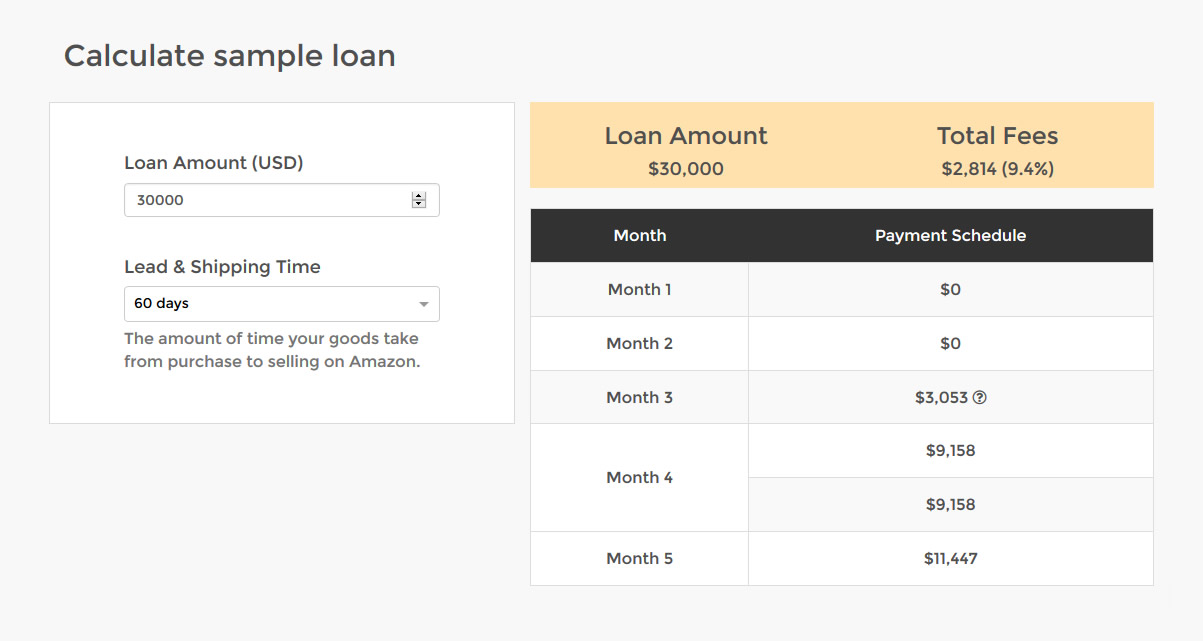

How much does it cost?

UpFund’s rates are 6-15%.

How is your rate cheaper than Amazon Lending and Kabbage?

- UpFund uses a flat fee rather then APR. This means fee's are not annualized. If you receive a 10% APR loan with another lender you are paying 20% annualized. With UpFund 10% is 10% and final.

- UpFund offer no payments during lead and shipping time. With other lenders If you are a private labeler you will be paying principal and interest during lead and shipping time. 30 days manufacturing and 30 days shipping is creating more interest fee's that you must pay without inventory being sold. So you must pay this principal and interest from your own pocket or borrow more money to pay this principal and interest you actually dont need.

- If you have a 60 day lead and shipping time we assume you create at lease 3 orders per year. This means you are paying 6 months worth of principal and interest which is eating away your profits and your not selling product.

How safe is my investment?

All Amazon sellers on UpFund.io are vetted for seasoned sales history, age of business and strength in buying power. These are strong sellers that have the ability to repay despite product outcome.

How does UpFund determine funding amount?

UpFund’s algorithm determines how much to fund a seller based on their historical sales data, units sold per month and overall strength of the business.

How is APY Calculated

How is Upfund's APY (Annual Percentage Yield) calculated?

APY is computed based on how long it takes to return the money, and how much it earns in that time, extrapolated over a year. Because each loan has multiple payments, each payment essentially will have it's own separate APY. We then combine all the APYs to compute the total APY on the entire investment.

Below is a mathematical explanation with an example, of how it works. Proceed with caution 🙂

For example, let's say that a campaign is paying back 5% ROI, and returns the investment over 3.5 months

The wrong way:

If you took the first, easy way out, you'd assume the APY for such a deal should be (5% * (12/3.5)) = ~17%. The problem is though, this assumes the entire loan is being paid back after 3.5 months, which is not the case. The loan is paid back in chunks, starting at 2 months.

The right way

In the first 1.5 months, there are no payments.

At the 2 month mark (60 days later), the first payment is made, which is 10% of the principal. For this partial sum, the APY is computed as follows:

p1 = 5% / 60 * 365 = 30% APY

==> This means that the first payment, which happens at the 60 day mark, has an APY of 30%.

At the 2.5 months mark (75 days later), the second payment is made, 30% of the principal. For this partial sum, the APY is computed as follows:

p2 = 5% / 75 * 365 = 24% APY

==> This means that the second payment, which happens at the 75 day mark, has an APY of 24%.

At the 3 month mark (90 days later), the 3rd payment is made, another 30% of the principal. For this partial sum, the APY is computed as follows:

p3 = 5% / 90 * 365 = 20% APY

==> This means that the first payment, which happens at the 90 day mark, has an APY of 20%.

At the 3.5 month mark, the last payment is made, 35% of the principal. For this partial sum, the APY is computed as follows:

p4 = 5% / 105 * 365 = 17% APY

The final APY is then calculated using a weighted average:

(p1 * 10 + p2 * 30 + p3 * 30 + p4* 35) / 105 = 22% APY

How many products can I raise funds for?

You may raise funds for 1 ASIN parent and all it’s children per campaign. Wholesalers and retail arbitrage sellers may raise based on historical sales data. If you wish to raise funds for multiple products, you must duplicate campaigns.

What type of sellers can crowdfund?

UpFund welcomes all Amazon sellers: Private Label, Wholesale, Retail and online Arbitrage sellers holding a seasoned history of earnings.

How much do I pay investors?

ROI to investors depend on the strength of your sales history and your credit history. At a minimum, fees range between 6% and 15%. Apply today to find out what your fee would be.

What is inventory consignment?

Inventory consignment is an arrangement in which inventory is left in the possession of another party to sell.

In our case, the investor contributes funds to enable the purchase of inventory that will be sold by the Amazon seller. From the time the investment is made to purchase the inventory until the product is sold, the product legally belongs to the consignor. In this case, the Amazon seller is the consignee (the one who is selling the inventory on the investor’s behalf) and the investor is the consignor (the one who legally owns the inventory until it’s sold).

How much funds can I raise?

Seller’s first campaign is limited to a principal amount of $75,000. This initial principal limitation may be changed or waived from time to time at UpFund’s discretion. All campaigns must have a minimum principal amount of $2,000.