We made it incredibly simple.

It is free and easy to sign up.No credit checks. No high pressure sales tactics.

Out of stock?

With funding from us, you’ll always have enough inventory

Need a boost?

Crank up your ad budget to improve sales and search rank.

Launch more products!

Let us help fund your next big launch.

We custom built our financing for Amazon sellers.

There is only one flat fee. No hidden charges.Payments are automatically made on your schedule and amount will depend on your sales, so it is always affordable.

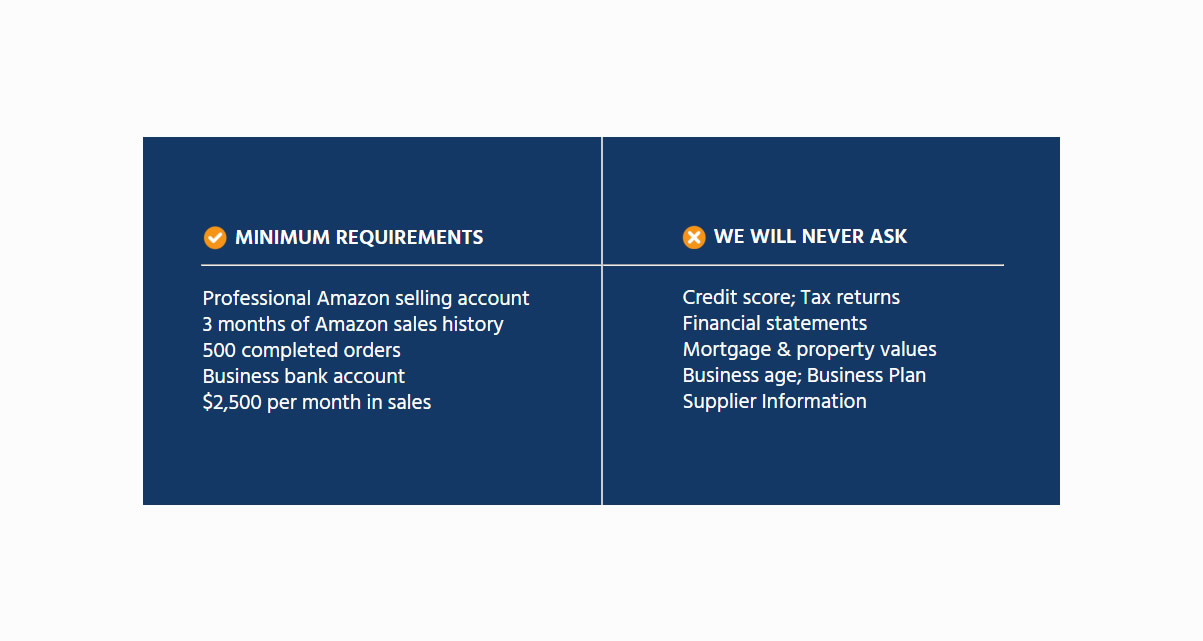

MINIMUM REQUIREMENTS

- Professional Amazon selling account

- 3 months of Amazon sales history

- 500 completed orders

- Business bank account

- $2,500 per month in sales

WE WILL NEVER ASK

- Credit score; Tax returns

- Financial statements

- Mortgage & property values

- Business age; Business Plan

- Supplier Information

FREQUENTLY ASKED QUESTIONS

How much does it cost?

While the amount and rate of each offer depends on a variety of risk factors, generally cost is 20-25% of how much you borrow. While this is certainly higher than bank loans, our one flat fee is far lower than the industry average of 30-40% of the funding amount.

Unlike loans which have an interest rate, we charge one flat fee which will never increase – even if it takes you to longer to pay off. This helps prevent you from being trapped in a mountain of debt if your sales decline.

Can I extend the term on my funding?

There is no fixed term on our financing – how long it takes to repay depends on the performance of your business.Since the amount you pay is a percentage of your gross Amazon revenue , you’ll pay your balance off faster if things are going well. But if sales decline, the percentage stays the same but it ends up being a smaller amount – allowing you more time to pay it off. And it never costs you a dime extra!

How does repayment work?

Each time Amazon transfers funds from your Seller account, we automatically collect a small percentage of your gross Amazon revenue. This helps keep your payments on track, but ensuring you still have plenty left to pay other bills.

What is a factor rate?

A factor rate is a multiplier which is used to calculate the total amount you will pay back, including fees. For example, if the factor rate is 1.25 on $10,000 borrowed, you’d pay back 1.25 x $10,000 = 12,500.

The remittance rate is used to calculate the amount of your payments. Each time Amazon deposits money to your bank account, this percentage is applied to the gross Amazon revenue to calculate how much you will pay towards your balance.

For example: if the remittance rate is 15% and your gross Amazon revenue is $1,000, you would pay $150 towards your balance.