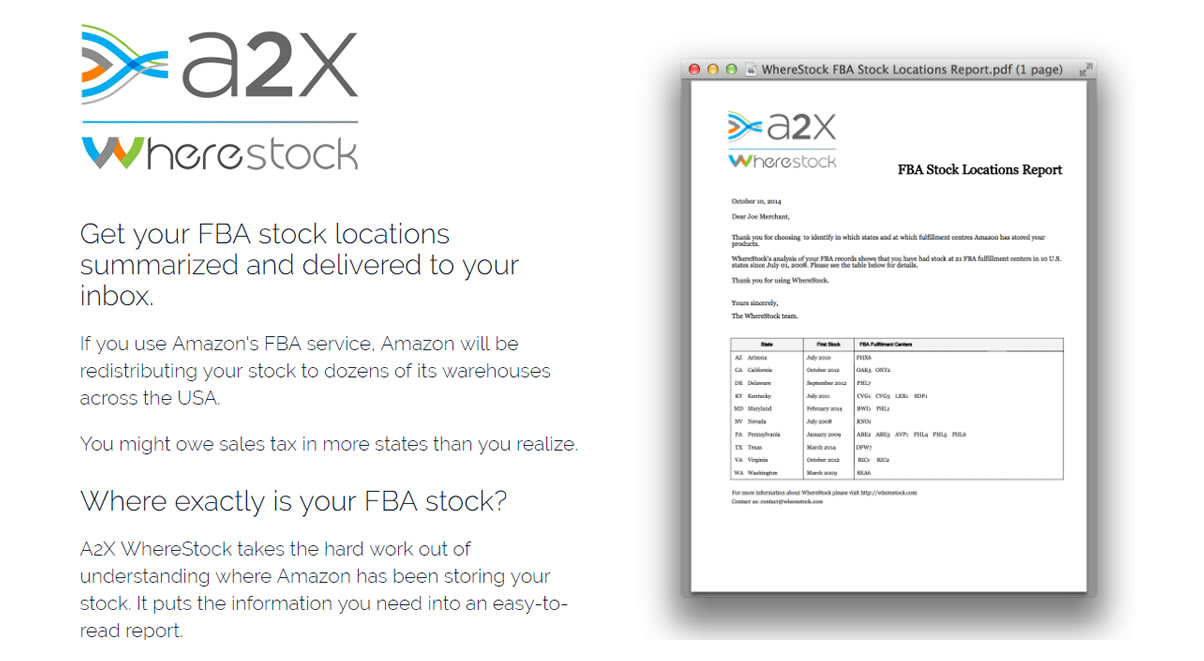

Get your FBA stock locations summarized and delivered to your inbox.

If you use Amazon’s FBA service, Amazon will be redistributing your stock to dozens of its warehouses across the USA.

You might owe sales tax in more states than you realize.

Where exactly is your FBA stock?

A2X WhereStock takes the hard work out of understanding where Amazon has been storing your stock. It puts the information you need into an easy-to-read report.

What does it cost?

For just $29 A2X WhereStock will deliver your FBA Stock Locations report to your inbox.

How it works

Three simple steps:

- You grant A2X WhereStock access to Amazon MWS.

- A2X WhereStock analyzes your FBA stock history and notifies you when your report is ready, so that you can confirm payment.

- Check your inbox for your FBA Stock Locations report.

Usually your report will be ready next business day.

Monthly Alert Service

Get peace of mind knowing that you’ll be notified whenever FBA relocates your stock to additional fulfillment centres. A2X WhereStock will email you with monthly updates on your FBA stock locations and will alert you when new states have been added.

Need Help With Your Amazon Accounting and Sales Tax?

These integrated cloud-based accounting services take the accounting headaches away for Amazon merchants.

The best way to account for your amazon merchant sales and fees.

Ecommerce Accounting Services.

Beautiful Accounting.

Helpful Amazon Resources

Articles we think will help FBA merchants understand sales tax, tax nexus and accounting for Amazon Sales.

Where are the Amazon Fulfillment Centers?

Amazon does not publish comprehensive information about it’s fulfillment centers. But for sellers in Amazon’s Fulfillment by Amazon Program (FBA) this can mean a huge headache when it comes time to collect and remit sales tax.

3 Things You Must Do Before Collecting Sales Tax on Amazon FBA

Let Amazon handle the fulfillment and customer service while you spend all your time on the fun stuff, like sourcing new product!

How Amazon Collects Sales Tax for Sellers

The scenario: you’re an FBA seller with a business who has registered for a sales tax permit in the state of Washington. You know there’s an Amazon fulfillment center there, meaning you have sales tax nexus in Washington and would therefore need to collect sales tax in order to comply with the state’s sales tax rules.

How to Change Your Product Tax Codes in Amazon

If you’re an Amazon seller like me, you may have a thousand (or more) different SKUs and the very idea of opening and updating each one is daunting. So, as promised in Part 1 of this short series for Amazon Sellers, here’s my post about a way to update your Product Tax Codes in Amazon without manually opening each one in Manage | Inventory